InsightsMonthly Market Wrap – June 2025

July 07, 2025 • 7 MIN READStress-tested but still standing

After a volatile spring shaped by tariff shocks, widening deficits, and geopolitical tensions, markets entered June facing serious tests. Yet despite the uncertainty, equity markets climbed, inflation remained contained, and signals from central banks offered a cautiously optimistic backdrop. While risks remain, the story halfway through 2025 is one of resilience.

Equity Markets

June extended the equity market rally, but leadership and dynamics varied by region. From a tech-fueled surge in the U.S., to a resource-driven rally in Canada, and a rebound in emerging markets, the month offered a diverse mix of tailwinds and narratives.

United States Equities:

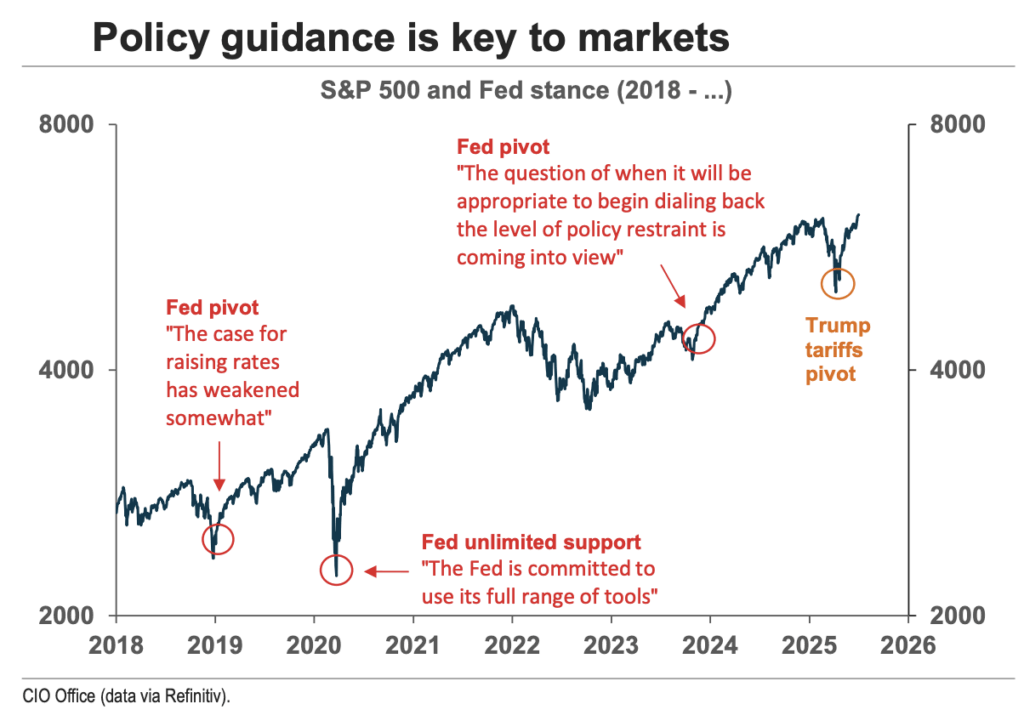

U.S. equities powered ahead in June, with the S&P 500 rising 5.1 percent as dovish signals from the Federal Reserve helped offset softer economic data. Markets responded positively to comments from Fed governors Waller and Bowman, who suggested rate cuts could begin as early as July, boosting both investor sentiment and equity valuations. As the old adage goes, “Don’t fight the Fed.” The chart below highlights how influential monetary policy guidance can be. Historically, shifts in the Fed’s tone have often coincided with turning points in market performance.

Tech led the charge, with the sector jumping 9.8 percent, supported by continued AI-driven momentum. Communication Services also impressed, gaining 7.3 percent, while Energy stocks rebounded 4.8 percent amid geopolitical tensions. Small-caps (Russell 2000) climbed 5.4 percent, signaling broadening market participation.

Still, not all areas are in the clear. Consumer Discretionary and Real Estate showed weaker relative performance. But overall, the market appears to be positioning for a soft landing, or at least a friendlier rate regime.

Canada:

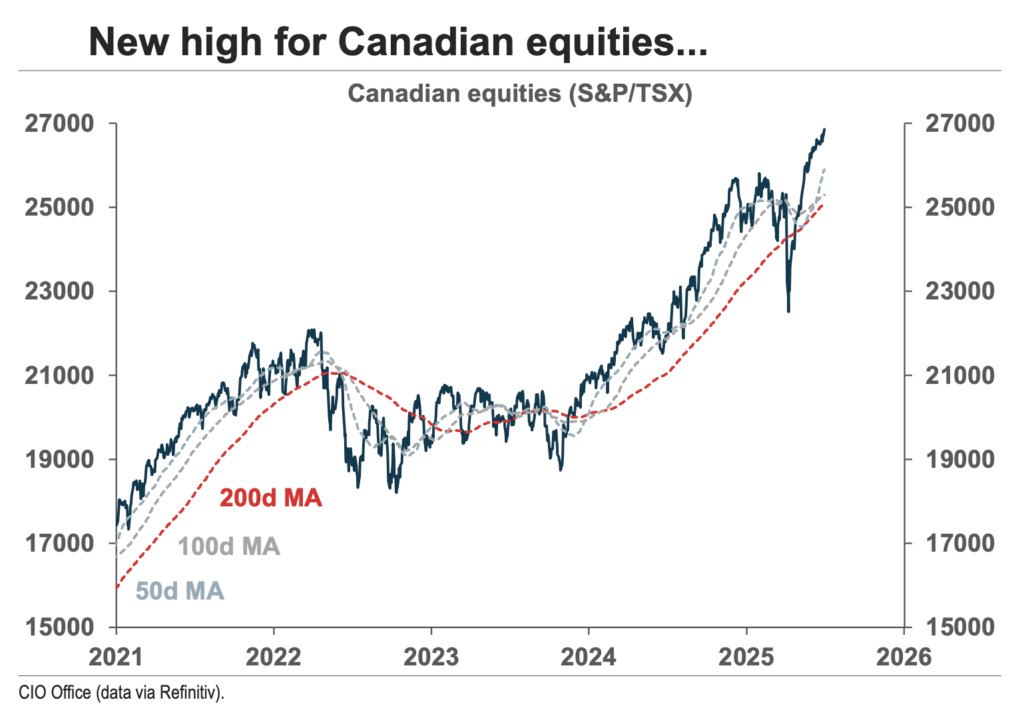

Canadian equities continued to outperform their global peers despite domestic economic softness. The S&P/TSX climbed 2.9 percent in June, bringing its year-to-date return to a robust 10.2 percent, bolstered by strong sector dynamics rather than macro tailwinds.

Health Care surprised with a 9.4 percent gain. Materials and Energy continued to benefit from firming commodity prices, including a rebound in oil. Technology posted another solid month, while Financials held steady with a 3.6 percent lift.

Despite rising unemployment and fragile GDP trends, equity markets appear to be looking past current weakness toward longer-term growth potential and policy normalization. Forward earnings growth estimates for Canadian stocks continue to trend higher into 2026 and 2027, reinforcing the case for capital flows into the region.

International Markets:

International markets delivered mixed results. After leading global returns through much of 2025, developed markets finally took a breather.

The MSCI EAFE Index (Europe, Australasia, and Far East) returned just 2.2 percent, its weakest showing this year. Weaker economic data in Germany and Japan and ongoing trade friction with the U.S. weighed on sentiment.

Meanwhile, emerging markets stole the spotlight. The MSCI Emerging Markets Index surged 6.1 percent, lifted by a softer U.S. dollar, improving capital flows, and easing global trade tensions. Continued strength in commodity-producing nations and a more constructive tone from China-U.S. trade negotiations further supported the EM rebound.

Fixed Income and Credit: The Fed Flirts with a Pivot

Bond markets steadied in Canada, which was flat for the second consecutive month. In the U.S., Treasuries posted modest gains of 1.3 percent as economic data disappointed, and the Fed began signalling potential cuts.

With Fed officials hinting at rate cuts, markets are now pricing in up to three reductions over the next 12 months. Duration positioning was brought back to neutral, reflecting a more balanced risk outlook in fixed income.

Commodities and Currency: Oil Rebounds, Dollar Weakens Again

Oil prices surged mid-month following Israeli airstrikes on Iran, before pulling back as ceasefire announcements calmed markets. WTI finished June up 7.9 percent, helping drive Energy sector strength.

Gold held steady after a strong multi-month rally, while copper continued to benefit from industrial demand, rising 5.3 percent.

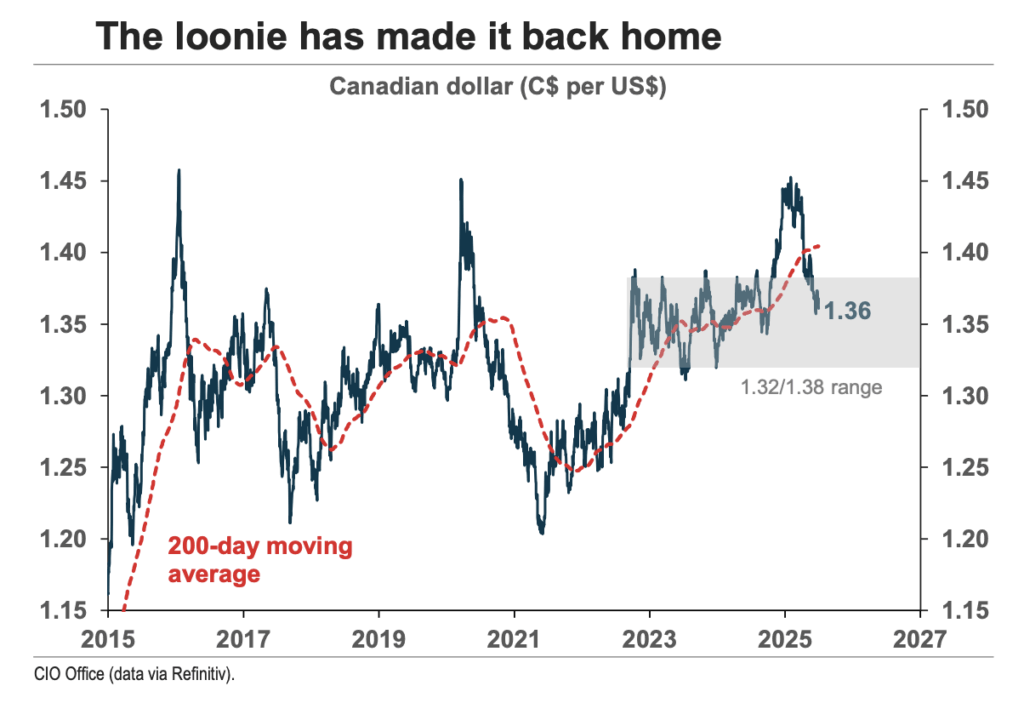

The U.S. dollar continued its 2025 decline, with the DXY index falling another 2.5 percent in June. It is now down more than 10 percent year-to-date, boosting the Canadian dollar, which appreciated another 1 percent during the month.

Economic Overview

The global economy remains on track for a cool down in the second half of the year. While volatility from trade policy and geopolitics persists, inflation remains in check and recession odds are falling.

United States: Slowing but Stable

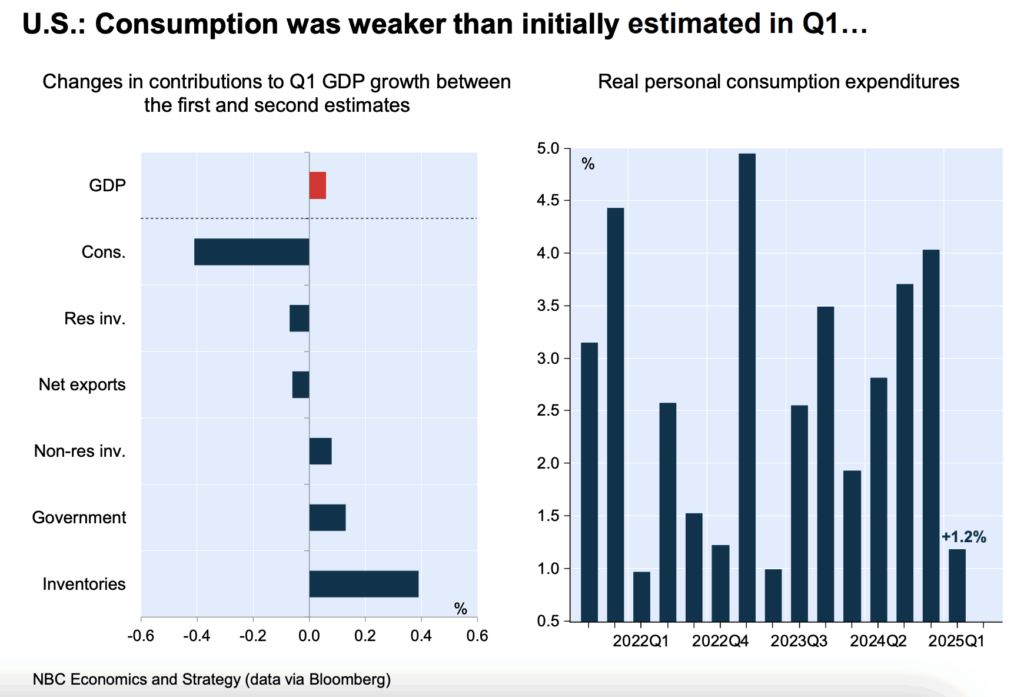

The U.S. economy is showing signs of deceleration. Real GDP growth slowed from 3.4 percent in the first quarter to just 0.5 percent in the second quarter on an annualized basis. A key driver of this slowdown was a decline in consumer spending, which came in much weaker than initially estimated. In fact, Q1 marked the softest pace of personal consumption growth in nearly two years, as shown in the chart below.

Despite softer growth, the labor market remains a pillar of stability. The hiring rate continues to outpace layoffs, and the quits rate remains above its long-term average, signaling that workers are still confident in job prospects.

Inflation has also remained well-behaved. Even with months of elevated tariffs, consumer prices have stayed within the Federal Reserve’s preferred 1 to 3 percent range, suggesting that many businesses are absorbing increased costs rather than passing them on to consumers.

In response, the Fed is now openly discussing the possibility of rate cuts. Markets are pricing in a shift toward a more neutral policy stance, with as many as three rate reductions anticipated before the end of the year. While the expiration of temporary tariff pauses in July and August presents some uncertainty, recent political developments point to a preference for de-escalation and negotiation.

The labour market remained relatively stable in May, with +177K payroll gains, though distortions from severance pay may have inflated the figures. Structural weakness is emerging among younger workers and the long-term unemployed. The Fed is expected to remain cautious, postponing any rate cuts until late 2025, as core PCE inflation rose at its fastest pace in over a year.

Canada: Weak Data, Strong Markets

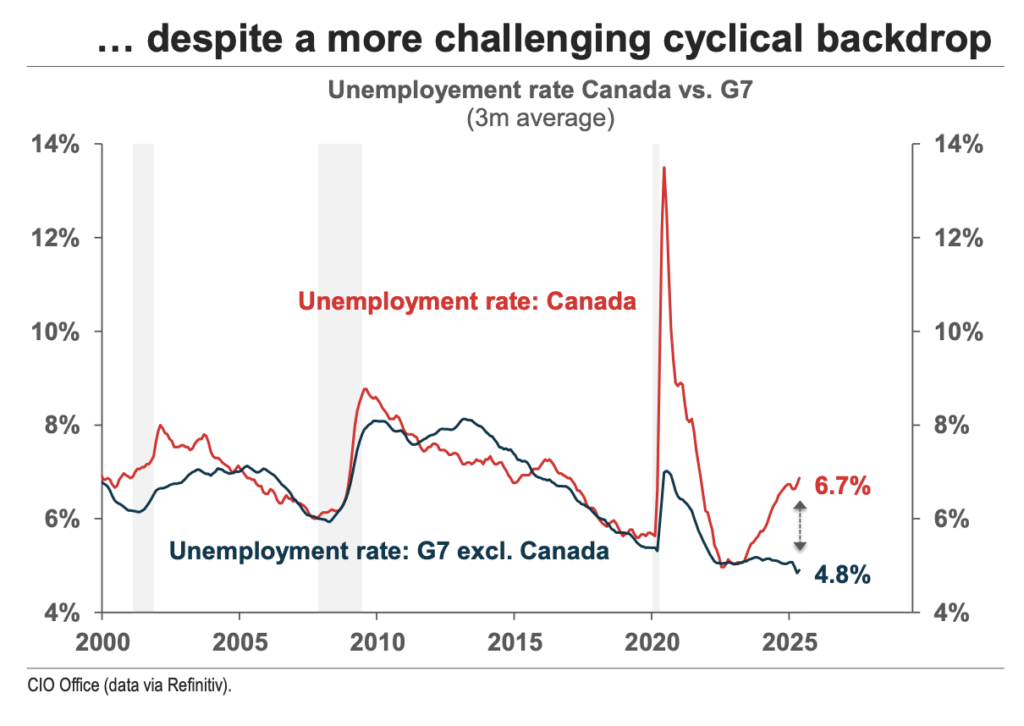

The Canadian economy continues to lag its global peers. GDP growth was flat in the second quarter, and the unemployment rate climbed to 6.7 percent. This stands in contrast to more stable labor conditions across the rest of the G7. As shown in the chart below, Canada’s jobless rate has been rising steadily, diverging from the broader G7 trend and highlighting a more fragile domestic backdrop.

The Bank of Canada left its policy rate unchanged in June, marking the second consecutive month of steady monetary policy. Inflation remains within the central bank’s 1 to 3 percent target range, providing room to hold rates while monitoring incoming data.

While the economic narrative in Canada remains subdued, the central bank’s flexibility and well-anchored inflation expectations offer some stability. The focus now turns to whether employment conditions can stabilize in the second half of the year or if further policy adjustments will be needed to support the labor market.

Final Takeaway: Entering the Second Half on Firmer Ground

If the first half of 2025 has shown us anything, it is that markets are capable of absorbing an incredible amount of turmoil. Between tariff shocks, surging geopolitical risk, and erratic policy shifts, investors have been thrown into a real-time stress test.

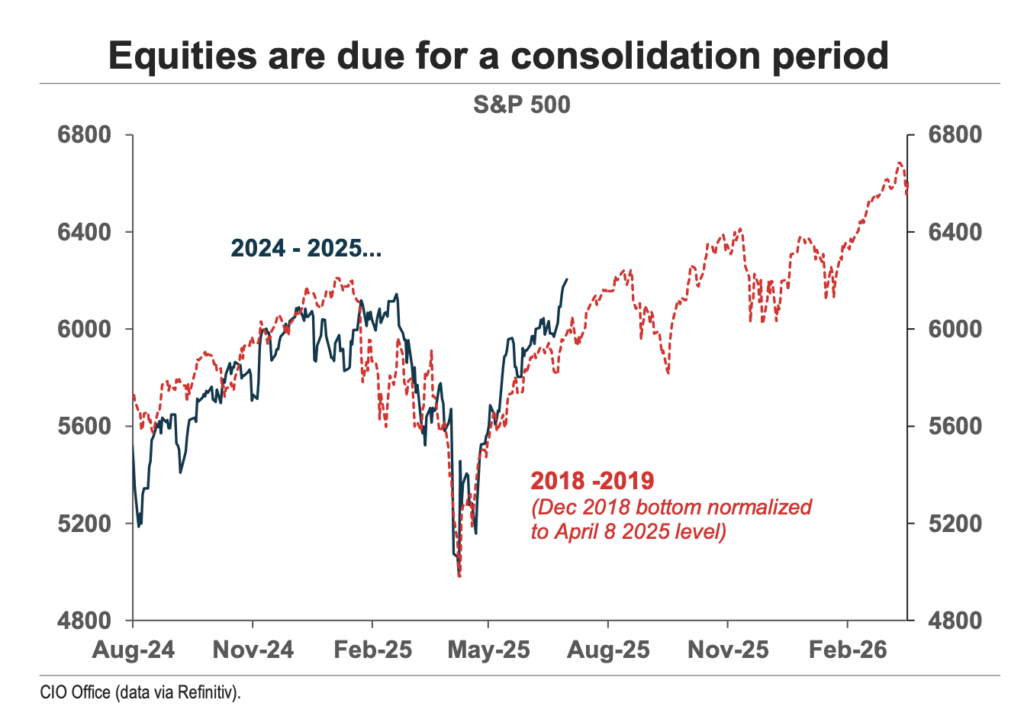

Now, however, sentiment appears to be leaning too far in the other direction. Optimism has returned in force, and risk assets are pricing in a near-perfect outcome. With valuations stretched, volatility low, and investors seemingly looking past every headline, we believe a period of consolidation is near.