InsightsMonthly Market Wrap – November 2025

December 17, 2025 • 6 MIN READEquity Markets

Global equity markets paused in November after a strong multi-month advance. After six consecutive gains, global equities broadly stalled as investors reassessed valuations, interest rate expectations, and the sustainability of earnings momentum heading into year-end. While global valuations remain elevated, the forward price-to-earnings ratio eased modestly in November after climbing to a five-year high last month. Volatility picked up mid-month, particularly in U.S. technology shares, as markets reacted to shifting expectations around the pace of monetary easing.

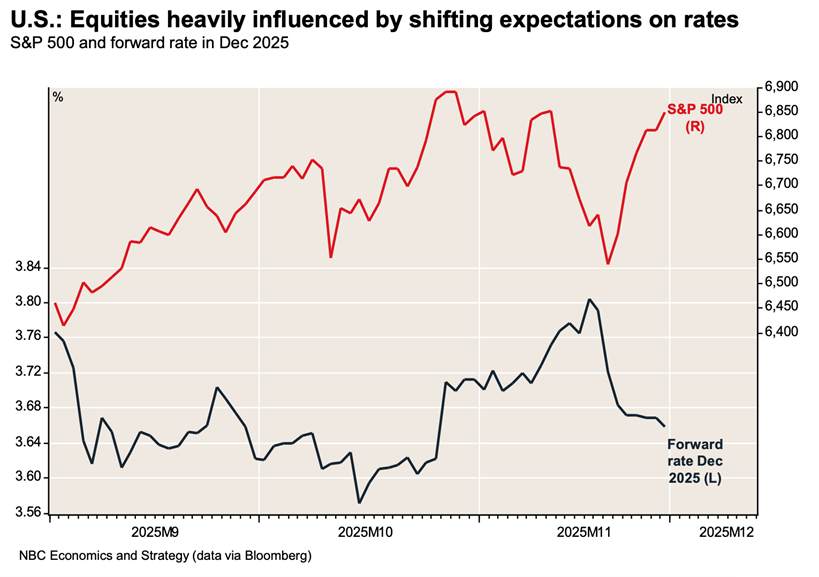

In the United States, equity performance was uneven. Despite a solid earnings season with broad-based upside surprises, investor expectations remain elevated. With valuations near the upper end of recent historical ranges, markets became more sensitive to any signs that rate cuts may arrive later or prove shallower than anticipated. This dynamic weighed on longer-duration growth stocks, particularly within the technology sector.

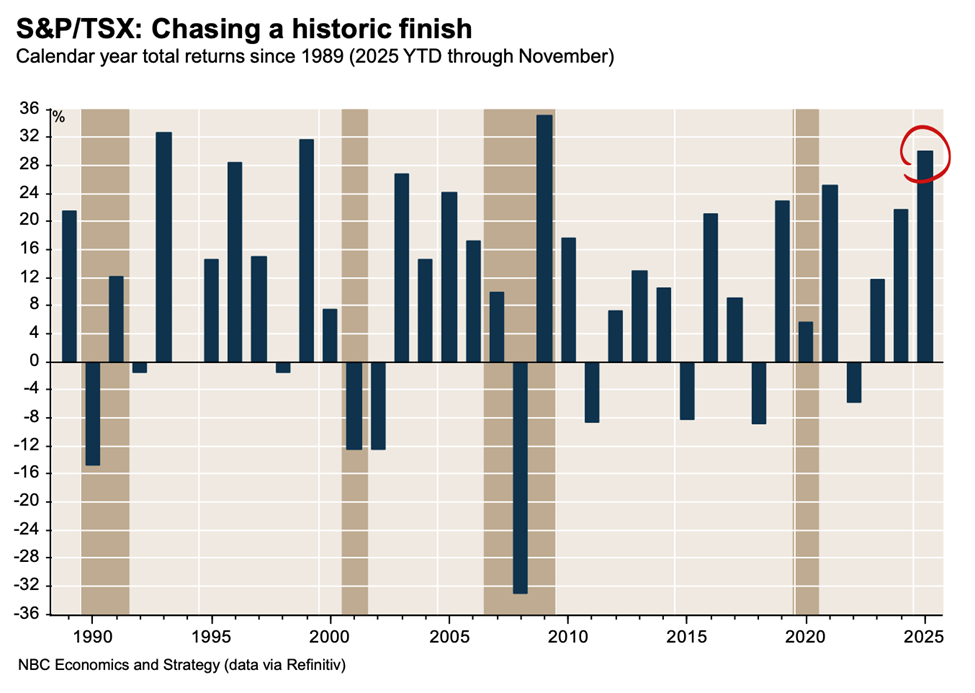

Canadian equities continued to stand out. The S&P/TSX extended its strong year-to-date performance, supported by materials, gold producers, and financials. Policy developments also played a role, as Ottawa’s November budget and subsequent federal–provincial agreements signaled a more pragmatic stance toward energy and capital investment. These shifts have reinforced investor confidence in Canada’s resource and industrial sectors.

International markets delivered mixed results. Parts of Europe and Japan benefited from improving earnings revisions, while emerging markets lagged as global risk appetite softened modestly toward month-end.

Fixed Income and Credit

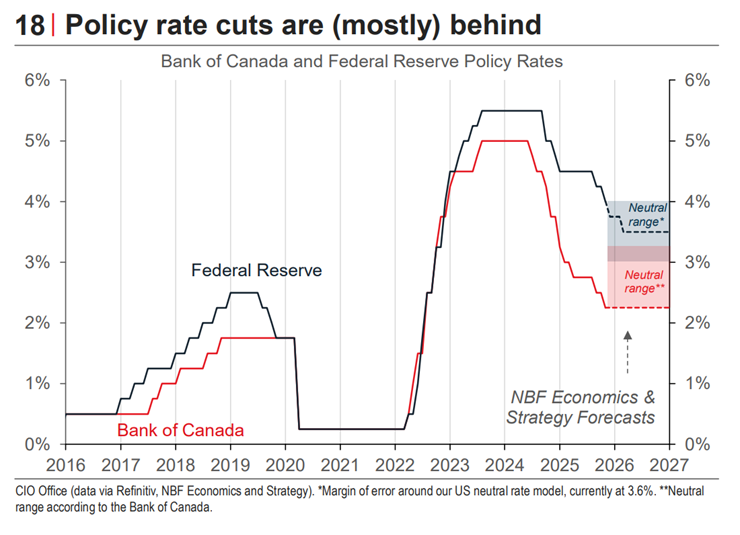

Bond markets were relatively stable in November. In Canada, fixed income returns were muted as markets increasingly priced in the view that the Bank of Canada is nearing the end of its easing cycle. In the United States, Treasury bonds posted modest gains as investors moved closer to fully pricing a December rate cut amid signs of labour market cooling. However, as we discussed at our recent luncheon, we continue to believe it will be difficult for the Federal Reserve to cut rates aggressively from here, particularly with inflation still running above target and policy rates already approaching neutral levels.

Credit markets remained constructive, with spreads contained and corporate balance sheets generally healthy. However, as with equities, investors are becoming more selective, favouring higher-quality issuers as economic uncertainty and political risks remain elevated heading into 2026.

Commodities and Currencies

Commodity markets were mixed during the month. Oil prices continued their downward trend, reflecting ample supply and cautious demand expectations. Gold, however, delivered another strong performance, benefiting from geopolitical uncertainty, central bank demand, and its role as a portfolio diversifier in an environment of elevated fiscal and political risk.

The U.S. dollar softened slightly in November, while the Canadian dollar found support from strength in commodities and renewed optimism around Canada’s energy and investment outlook. Currency markets remain sensitive to diverging monetary policy paths and shifting growth expectations across regions.

Economic Overview

Canada

Canada’s economic backdrop continues to feel constrained, with growth struggling to gain traction even as interest rates have moved lower. While headline data has been uneven, the underlying picture points to a delicate balance between slowing demand and persistent inflation pressures.

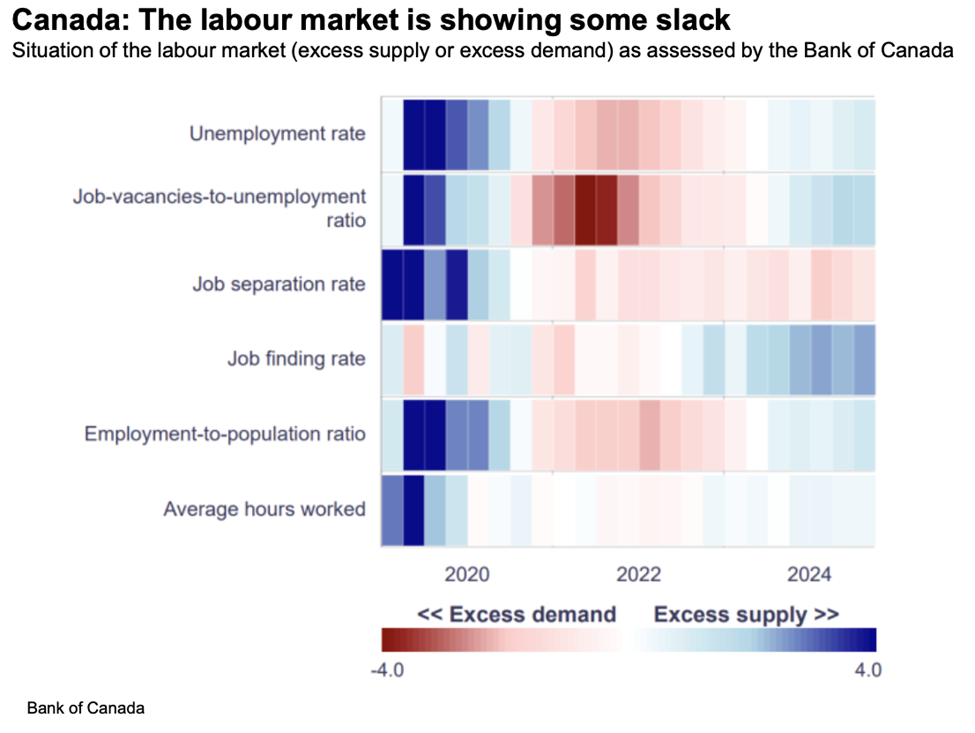

The Bank of Canada delivered its second consecutive rate cut in October, bringing the policy rate to what it considers a neutral or slightly stimulative level. However, policymakers have signaled that further cuts are unlikely in the near term. That view has strengthened as recent data surprised modestly to the upside, including stronger-than-expected third-quarter GDP growth and a rebound in headline employment. Despite these encouraging signals, domestic demand remains weak, and other labour market indicators suggest underlying slack remains elevated.

One of the more challenging dynamics for policymakers has been wage growth. Despite evidence of excess labour supply, wage pressures have accelerated over the past year, particularly in negotiated wage settlements. This has kept services inflation elevated, even as goods inflation has cooled meaningfully. As a result, progress on inflation has stalled, reinforcing the Bank of Canada’s cautious stance and making aggressive rate cuts difficult to justify in the near term.

Looking ahead, fiscal policy is expected to play a larger role in supporting the economy. Recent federal budget measures aimed at boosting household consumption, housing investment, and business spending have helped cushion the slowdown in 2025 and should support a modest recovery in 2026, assuming trade tensions with the United States ease. That said, Canada’s medium-term growth outlook remains constrained by slower population growth and weak productivity, suggesting any recovery is likely to be gradual rather than robust.

United States

The U.S. economic picture remains more resilient, though recent data has been clouded by the federal government shutdown, which temporarily disrupted economic reporting and weighed on fourth-quarter growth. According to estimates, the shutdown likely subtracted meaningfully from near-term activity, but much of that lost output is expected to be recouped in early 2026 once government operations normalize.

Beyond the shutdown, underlying momentum in the U.S. economy remains intact. Financial conditions have eased considerably, fiscal policy has turned more supportive than previously expected, and household balance sheets continue to benefit from rising asset prices. Together, these forces should help keep U.S. growth modestly above potential into next year, even as population growth slows.

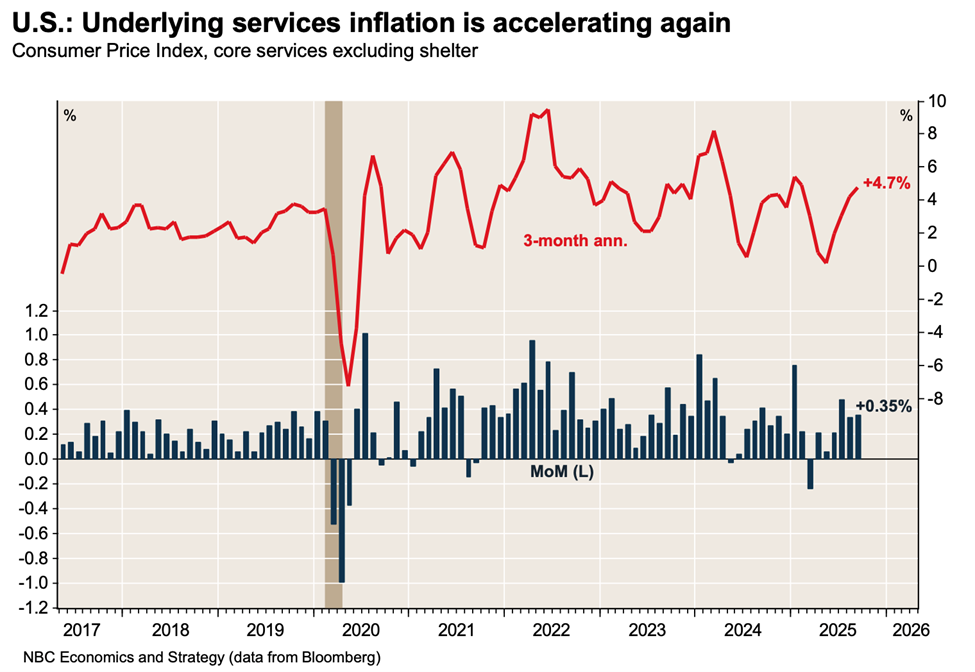

Inflation, however, remains the key risk. While headline inflation has moderated, underlying services inflation has shown renewed firmness, particularly when excluding shelter. Core services inflation remains inconsistent with a sustained return to the Federal Reserve’s 2% target, and recent data suggests tariff-related price pressures may be re-emerging in certain goods categories. With economic capacity already stretched and financial conditions loose, additional stimulus risks reigniting inflationary pressures.

As a result, while the growth outlook remains constructive, the path for monetary policy is far less certain. We continue to believe it will be challenging for the Federal Reserve to deliver the extent of rate cuts currently priced by markets. Even if policy rates decline modestly, elevated long-term yields could offset much of the intended easing effect, keeping overall financial conditions tighter than investors expect.

Bottom Line

As we head toward 2026, markets continue to benefit from resilient economic growth, particularly in the United States. That said, strong economic conditions do not preclude periods of market volatility or correction. History reminds us that market pullbacks often occur when the economic backdrop still appears healthy.

Valuations remain elevated across many equity markets, and market leadership has become increasingly concentrated in a narrow group of large companies. This concentration has amplified returns over the past year, but it also increases vulnerability should sentiment shift or earnings expectations disappoint.

With policy rates now closer to neutral, the tailwind from monetary easing is likely to be more limited from here. Combined with geopolitical risks, fiscal uncertainty, and lingering inflation pressures, the investment environment heading into 2026 appears more balanced and less forgiving than it has been over the past year.

In this context, we continue to emphasize diversification, quality, and discipline. Maintaining a long-term perspective, managing risk thoughtfully, and avoiding overconcentration remain key as markets navigate what could be a more volatile phase of the cycle.