InsightsThe Wealth Effect: A Powerful Driver and a Growing Economic Risk

January 14, 2026 • 5 MIN READWhen investors and economists debate recession risk, the conversation typically centers on labour markets, inflation, or interest rates. While these indicators matter, they all feed into one dominant force that ultimately determines economic outcomes: consumer spending. In Canada, consumption accounts for roughly 54 percent of GDP. In the United States, that figure exceeds 68 percent. If consumption remains resilient, economic growth can persist even in the face of tighter financial conditions. If it falters, recession risk rises rapidly.

At this stage of the economic cycle, understanding consumption requires a deeper look at the wealth effect. The wealth effect describes the tendency for households to increase spending as their perceived wealth rises, particularly when asset prices such as equities or housing appreciate. While the concept is well established, its importance today is elevated due to two structural realities: who controls spending power and what now drives household wealth.

Consumption Is Concentrated, Not Broad-Based

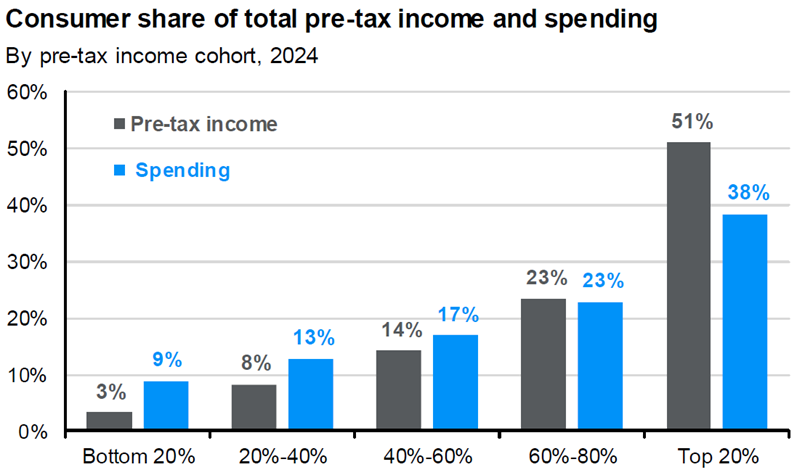

A critical mistake in macro analysis is assuming that all consumers matter equally. In reality, spending is highly concentrated. In the United States, the top 20 percent of income earners account for roughly 40 percent of total consumer spending, despite representing only one fifth of households. This same group earns the largest share of pre-tax income and, more importantly, owns approximately 85 percent of the equity market.

This concentration is well illustrated in data from J.P. Morgan Asset Management’s Guide to the Markets, which highlights how consumption scales sharply with income and wealth rather than population size. You can explore that data directly in their materials here:

👉 https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

The implication is straightforward but profound. The consumers who matter most for aggregate demand are also the consumers most exposed to financial markets. Their spending behavior is not driven solely by wages or employment conditions, but by portfolio values, confidence, and perceived financial security.

How the Wealth Effect Fuels Growth

This is where the wealth effect becomes a powerful economic accelerant. When equity markets rise, higher-income households experience an increase in net worth. That increase boosts confidence and encourages spending on discretionary goods, travel, services, and investment. Increased spending supports corporate revenues and profits, reinforcing market strength and employment in a self-reinforcing cycle.

Former U.S. Federal Reserve Chair Ben Bernanke described this dynamic clearly in a 2010 op-ed, noting that higher stock prices boost consumer wealth, raise confidence, and spur spending, creating a virtuous circle that supports economic expansion. While his comments were made in the context of quantitative easing, the underlying principle applies whenever asset prices rise meaningfully.

The wealth effect is often visualized as a feedback loop between asset prices, confidence, spending, and economic growth. A clear and intuitive diagram of this relationship can be found here:

👉 https://www.aesinternational.com/blog/beware-of-the-wealth-effect

History supports this framework. Following the equity market recovery after 2009, U.S. household wealth surged and consumption growth accelerated, helping to drive one of the longest economic expansions on record. More recently, Visa’s economic research has attempted to quantify the magnitude of the wealth effect, estimating that each additional dollar of household wealth can generate up to 34 cents of incremental spending. Visa has repeatedly noted that spending growth remains strongest among the highest income brackets, even as inflation moderates.

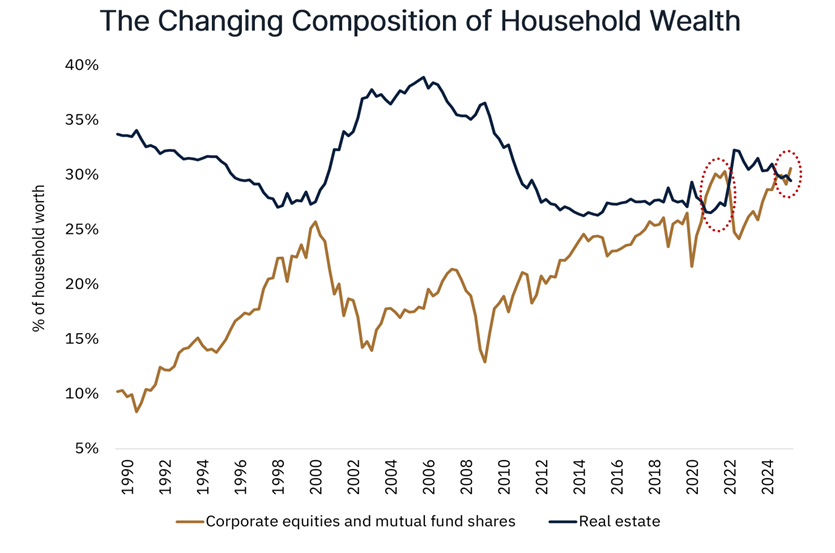

The Changing Composition of Household Wealth

What makes the current environment different from prior cycles is what now drives household wealth. Over the past three decades, the composition of U.S. household wealth has evolved significantly. Historically, real estate dominated household balance sheets. Today, that is no longer the case.

According to analysis from Canoe Financial, equities have surpassed real estate as the largest contributor to U.S. household net worth for only the second time on record, with the previous instances occurring around the year 2000 and again briefly at the end of 2021. You can review Canoe’s full analysis and chart here:

👉 https://www.canoefinancial.com/insights-news/insights/cotw-the-changing-composition-of-household

This shift has meaningful implications. It helps explain why consumption has remained resilient despite higher interest rates, tighter credit conditions, and ongoing affordability pressures in housing. For the households that drive a disproportionate share of spending, equity market gains have more than offset weakness elsewhere on the balance sheet.

A Double-Edged Sword for the Economy

While the wealth effect has supported growth, it also introduces a new source of fragility. The same mechanism that fuels consumption during rising markets can amplify downside risk when markets fall. If consumption is increasingly driven by asset prices rather than income growth alone, the economy becomes more sensitive to equity market volatility.

Traditionally, economists looked for recession signals in the labour market. Job losses reduced income, income declines reduced spending, and falling consumption eventually fed back into weaker corporate earnings and equity prices. In that framework, markets reacted to economic deterioration.

Today, the causality may increasingly run in reverse. With equities now the primary driver of household wealth, a sustained market decline could directly undermine confidence and spending among the top consumption cohort, even if employment remains relatively stable. Given that the top 20 percent accounts for roughly 40 percent of total spending, even modest behavioral shifts could have an outsized impact on GDP growth.

In this environment, markets may be leading the economy rather than responding to it.

Why This Matters for Investors

The wealth effect remains a powerful tailwind as long as asset prices hold firm. Strong markets support consumption, which in turn supports earnings and economic growth. But that support comes with increasing dependence on continued asset appreciation.

Looking ahead, the key risk is not simply whether unemployment rises or inflation reaccelerates. It is whether equity market declines erode confidence among the households that matter most for spending. When the wealth effect turns, it can shift quickly from a stabilizing force to a catalyst for economic slowdown.

For investors, this underscores the importance of quality, diversification, and risk management. In a market-led economy, volatility matters not just for portfolios, but for the broader economic cycle itself.