InsightsMonthly Market Wrap – December 2025

January 14, 2026 • 7 MIN READDecember closed without the traditional “Santa Claus rally” investors often anticipate at year-end. Instead of a late-season surge, markets showed signs of fatigue following a strong run earlier in the year, as elevated valuations, shifting interest rate expectations, and increased market concentration weighed on sentiment. While economic data remained broadly supportive, particularly in the United States, investors appeared more cautious heading into 2026, opting to consolidate gains rather than extend risk. The result was a more subdued finish to an otherwise strong year, reinforcing the view that markets are transitioning into a more balanced and potentially volatile phase.

Equity Markets

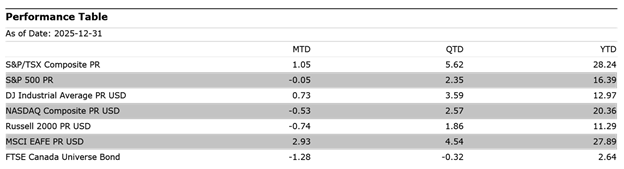

Equity markets were mixed in December as investors reassessed positioning after a strong year-to-date rally. See performance table below:

In the United States, major indices struggled to gain traction, with weakness concentrated in growth-oriented segments such as technology and small-cap stocks. Market leadership remained narrow, and performance dispersion widened as investors became more selective, favoring companies with stronger balance sheets and more predictable earnings profiles.

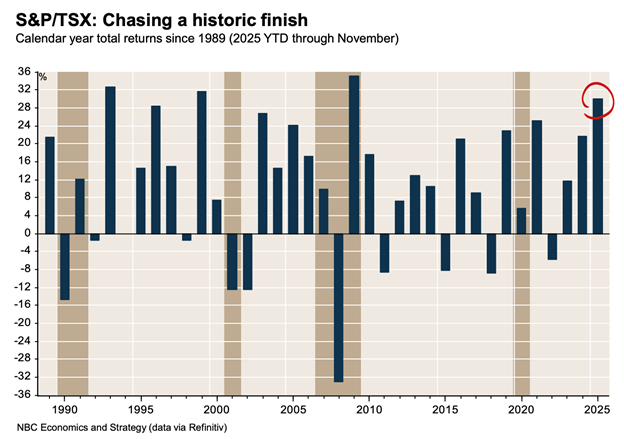

Canadian equities were a relative bright spot. The S&P/TSX benefited from continued strength in materials, particularly gold-related equities, as well as resilience in financials. Canada’s market structure, with its heavier exposure to commodities and income-oriented sectors, helped offset some of the valuation pressures seen in U.S. markets.

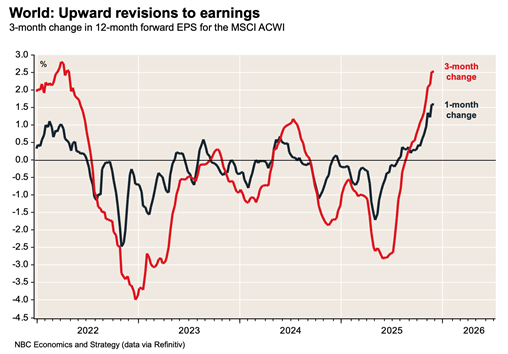

International equities delivered solid results in December. Developed markets outside North America benefited from improving earnings trends and more attractive valuations, particularly in Europe and Japan. The strong performance of international equities in 2025 served as a reminder of the benefits of global diversification after several years of U.S.-centric returns.

Fixed Income and Credit

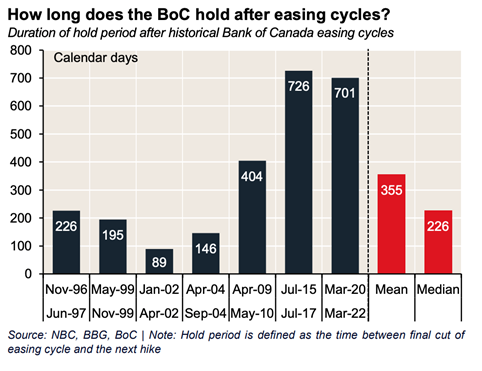

Fixed income markets faced modest headwinds in December as bond yields moved higher, particularly at the longer end of the curve. With much of the anticipated rate easing already priced in, investors became more sensitive to signs that central banks may be approaching the limits of their easing cycles.

In Canada, bond returns were slightly negative for the month as the Bank of Canada reinforced a cautious stance, emphasizing that inflation risks have not fully dissipated.

In the United States, Treasury yields rose as markets recalibrated expectations for the pace and magnitude of future Federal Reserve rate cuts. As discussed in recent Verus Podcasts and Wealth Notes, while policy rates may drift lower over time, aggressive easing from current levels appears unlikely.

Credit markets remained relatively stable. Corporate fundamentals are still generally healthy, but investors continue to differentiate more sharply between higher- and lower-quality issuers. This environment continues to reward disciplined credit selection and a focus on income durability rather than yield chasing.

Commodities and Currencies

Commodity markets were mixed in December. Gold extended its strong performance, supported by ongoing geopolitical uncertainty, central bank demand, and its role as a portfolio diversifier amid elevated valuations in risk assets. Energy prices, by contrast, remained under pressure as ample supply and moderate demand expectations weighed on sentiment.

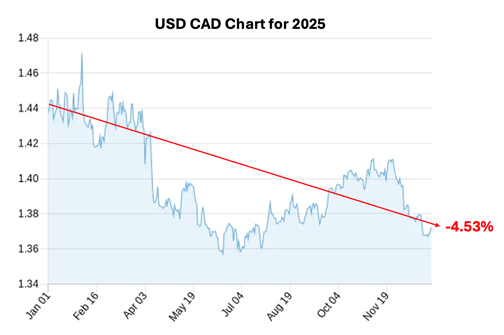

Currency markets were relatively subdued in December, but currency movements were a meaningful factor for investors over the full year. The Canadian dollar found support from strength in commodity prices, while the U.S. dollar weakened against the loonie, declining approximately 4.5% over 2025. This created a notable headwind for Canadian investors holding U.S. assets, as currency translation reduced reported returns despite strong underlying equity performance. While this dynamic understated the fundamental performance of U.S.-based investments within globally diversified portfolios, it also reinforces the importance of currency exposure as a key driver of outcomes, particularly in years marked by significant foreign exchange shifts.

Economic Overview

US Economics:

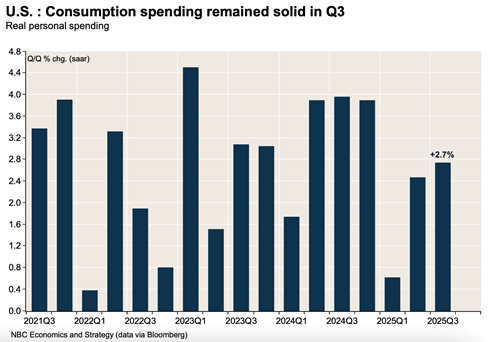

The U.S. economic backdrop remains more resilient than most developed markets, though recent data point to a gradual cooling rather than renewed acceleration. Consumer spending has held up well, supported by rising asset prices, real income growth, and continued investment in technology and artificial intelligence. Business investment, particularly in information and communication technology, has remained a key contributor to growth, helping offset softer conditions in more interest-rate-sensitive areas of the economy.

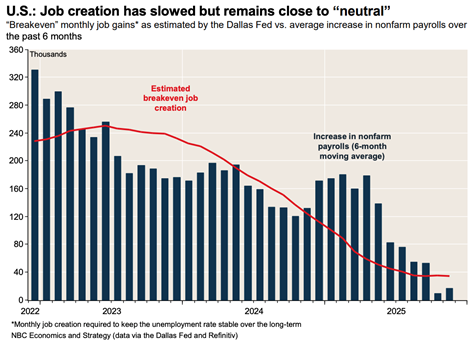

That said, beneath the surface, the labour market has begun to show signs of fatigue. Job creation has slowed meaningfully, particularly among small and mid-sized businesses, and the unemployment rate has edged higher from its cycle lows. Measures such as the quit rate and hiring intentions suggest workers are becoming less confident in their ability to change jobs, a typical late-cycle signal. While layoffs remain contained and job growth is still close to levels needed to keep unemployment stable, the trend points toward easing labour market conditions rather than continued tightening.

Inflation remains the central challenge for policymakers. Although headline inflation has moderated, underlying services inflation remains elevated, and recent data suggest price pressures could re-emerge if growth remains above potential. As a result, while markets continue to price in rate cuts in 2026, the Federal Reserve is likely to proceed cautiously. Even modest easing may be offset by higher long-term yields, limiting the overall impact on financial conditions.

Looking ahead, the U.S. economy is expected to slow modestly but avoid a sharp downturn. However, strong economic fundamentals do not preclude periods of market volatility or correction, particularly with valuations elevated and equity market leadership increasingly concentrated. This dynamic reinforces the importance of distinguishing between economic strength and market risk as we move into 2026.

Canadian Economics:

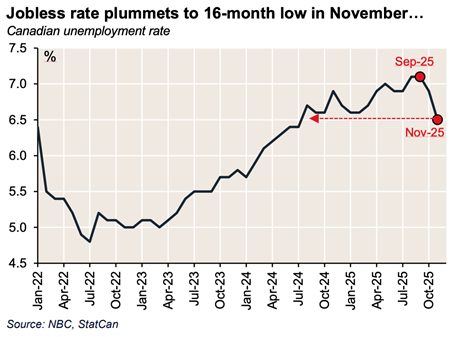

Canada’s economic picture remains fragile. Late-2025 data surprised modestly to the upside, driven largely by a sharp decline in the unemployment rate to 6.5% following several months of solid job gains. However, this improvement was concentrated over a short period and appears to have been influenced more by labour force dynamics than by a broad-based strengthening in economic activity. Importantly, domestic demand, business investment, and hiring intentions did not show a comparable improvement.

As we moved into early January, a meaningful portion of that decline in the unemployment rate had already begun to reverse, reinforcing concerns that late-year labour market strength overstated underlying momentum. Other indicators, including business surveys and payroll-based employment data, continue to point to softness, particularly in interest-rate-sensitive sectors such as housing and construction. Household credit growth remains subdued, and housing activity, when adjusted for population growth, remains well below historical norms.

In this environment, the Bank of Canada has signaled a willingness to remain patient. While policy rates have moved lower, officials recognize that rate cuts to date have not fully filtered through to household and business borrowing costs, particularly given the limited decline in longer-term rates. Looking ahead, Canada’s recovery is expected to be gradual, supported by fiscal initiatives and a potential easing of trade-related uncertainty, but constrained by elevated debt levels and ongoing sensitivity to interest rates.

Bottom Line

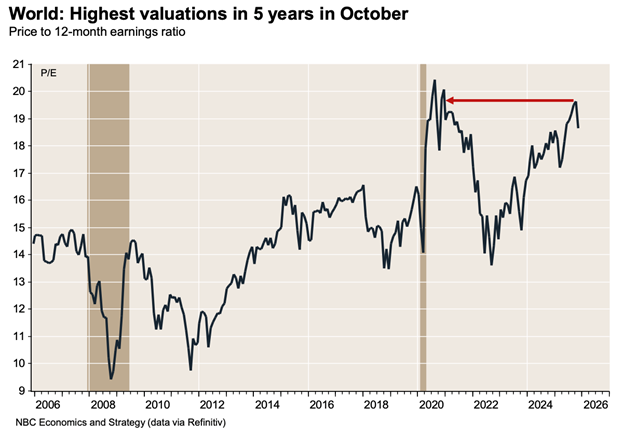

December marked a pause rather than a reversal, but it reinforced several important themes heading into 2026. Valuations remain elevated across many equity markets, leadership is increasingly concentrated, and policy support is becoming less certain. While the U.S. economy continues to show resilience, strong economic conditions do not eliminate the risk of market corrections.

As we enter the new year, we remain focused on diversification, quality, and disciplined portfolio construction. In an environment where returns may be less broad-based and volatility more frequent, maintaining balance and flexibility will be critical to navigating the next phase of the market cycle.