InsightsMonthly Market Wrap – September 2025

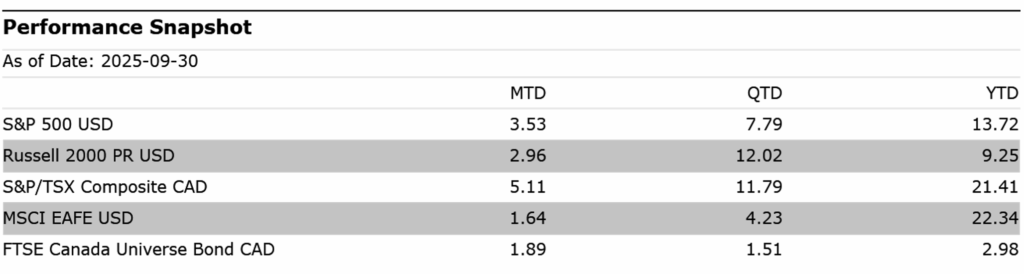

October 08, 2025 • 5 MIN READSeptember 2025 marked the close of a remarkably strong quarter for financial markets, with equities rallying globally despite the backdrop of rising trade tensions, sticky inflation, and diverging central bank actions. The S&P/TSX reached a new record high, powered by surging gold stocks, while U.S. and emerging market equities posted broad gains. Central banks in both Canada and the U.S. pivoted toward easing, offering modest support. Yet under the surface, the economic narrative remains mixed: labour markets are softening, and the divergence between Canada and the U.S. appears to be widening as Canada grapples with contraction while U.S. growth remains resilient.

Equities: Gold-Driven Gains and Tech Resilience

September closed out a stellar third quarter for equity markets. The S&P/TSX rose 5.11% on the month, bringing year-to-date gains to 22.34%, the best 9-month performance since 2009. Leading the charge? Gold stocks, up an extraordinary 97% YTD, thanks to inflation hedging, a weaker U.S. dollar, and global fiscal uncertainty

Canadian sector standouts in Q3 included:

- Materials: +37.8% (79.3% YTD)

- Energy: +12.6%

- Financials: +10.6%

South of the border, the S&P 500 gained 3.53% in September and 7.79% in Q3, driven by continued strength in mega-cap tech and telecoms. Year-to-date, the index is up 14.8%, with Information Technology (+22.3%) and Communication Services (+24.5%) as leaders.

Globally, the MSCI EAFE advanced 1.64% in September and 4.23% in Q3, buoyed by an impressive 10.9% Q3 gain in Emerging Markets, which are now up 28.2% YTD.

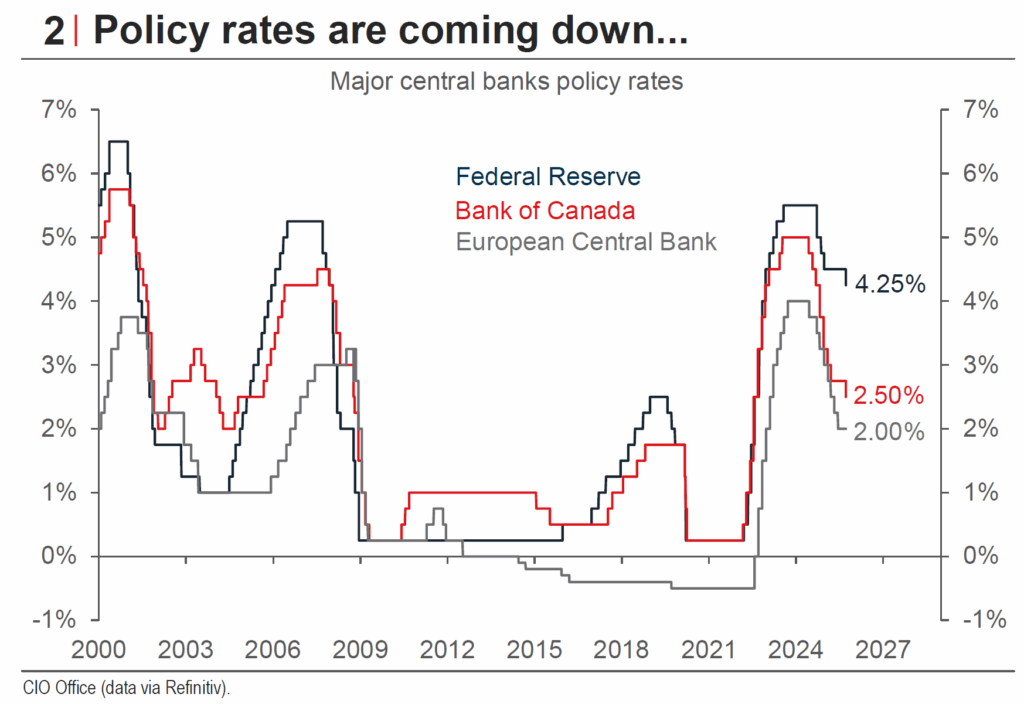

Fixed Income & Credit: A Dovish Turn… For Now

After months of “higher for longer,” central banks blinked. The Federal Reserve cut rates in September, calling it a “risk management” decision amid weakening labour data. The Bank of Canada followed suit, citing deteriorating growth and fading inflation pressures

This policy pivot lifted bond prices across the curve:

- Canadian bonds (ICE Universe): +1.8% (Sep), +1.4% (Q3)

- U.S. Treasuries: +0.9% (Sep), +1.6% (Q3)

- U.S. High Yield: +0.8% (Sep), +2.4% (Q3)

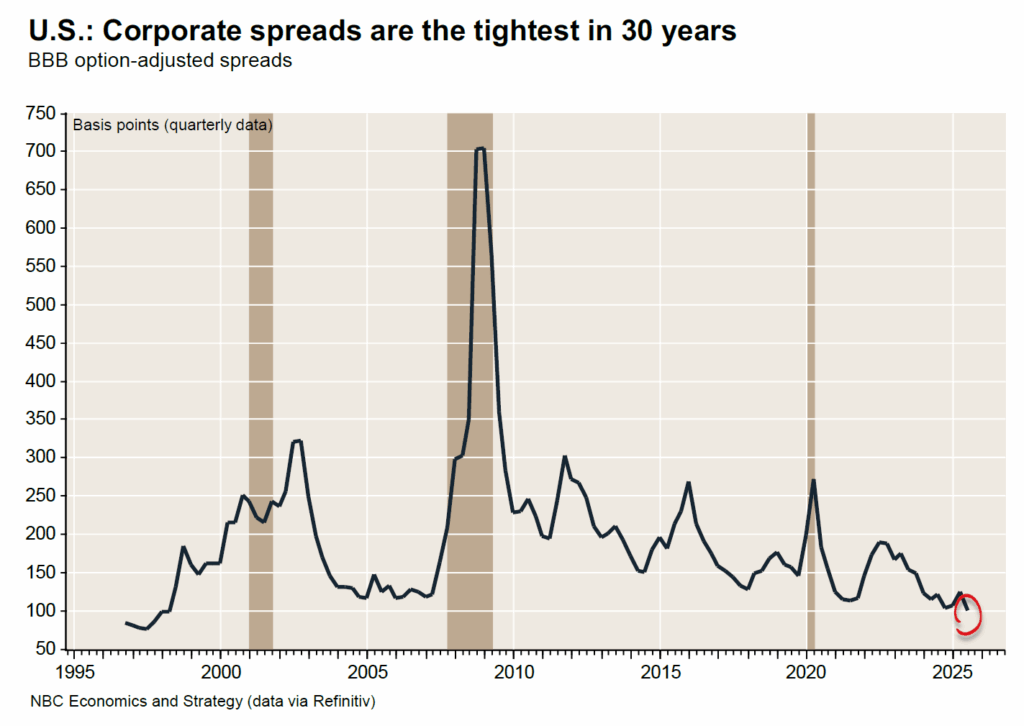

Credit spreads remain tight, particularly in the U.S., where BBB spreads are at 30-year lows, suggesting little pricing for risk.

However, with core inflation still elevated, and no clear signal of an imminent recession, the scope for aggressive easing may be more limited than markets expect.

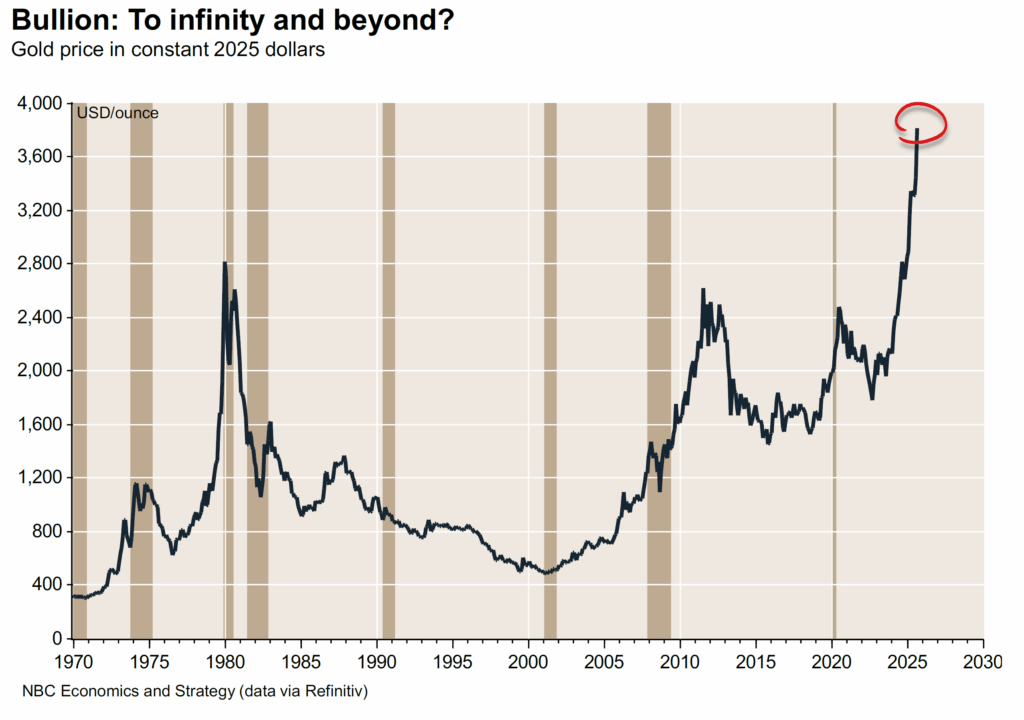

Commodities & Currency: Gold Shines, Oil Slips

Gold stole the spotlight in September, rising 11.4% on the month and 46.0% YTD. Its surge reflects a potent mix of inflation anxiety, fiscal deterioration, and demand for safe havens as geopolitical uncertainty and tariff escalation linger.

Meanwhile:

- Oil (WTI) declined -1.8% in September and is down -12.8% YTD

- CAD/USD rose +1.3% in September, but is still down -3.2% YTD

- The U.S. dollar staged a modest Q3 rebound (+0.9% DXY) after significant weakness earlier in the year.

U.S. Economic Overview: Labour Market Under the Microscope

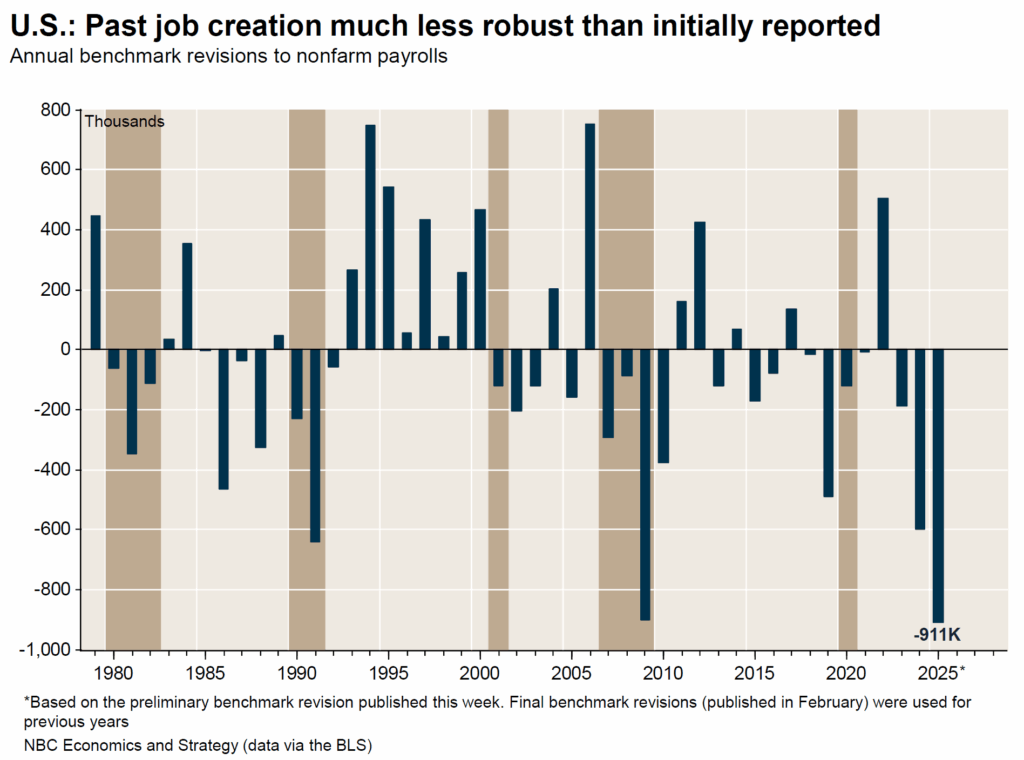

The most notable shift in September wasn’t a headline print—it was the revision of past jobs data. The Bureau of Labor Statistics announced that U.S. payroll growth had been overstated by 911,000 jobs, the largest downward revision on record.

Key developments:

- Job creation has slowed to ~29K/month, the weakest since 2010 (ex-pandemic)

- Long-term unemployment is rising, especially among young adults

- Manufacturing jobs—supposed beneficiaries of tariffs—are declining

- Unemployment rate rose to 4.3%

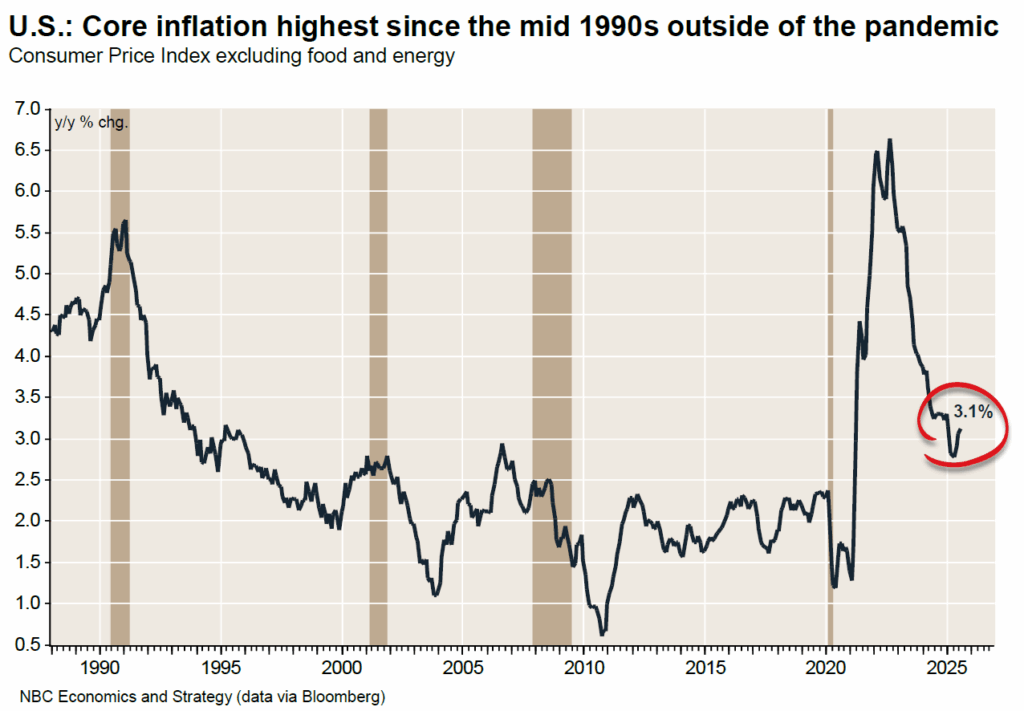

And inflation? Despite cooling headline figures, core inflation remains near mid-90s levels, creating a headache for policy.

Despite this, GDP growth in Q3 looks solid, supported by strong consumption. The Fed now walks a tightrope: inflation remains sticky at nearly 3% core, while labour softness suggests further cuts may be necessary. Markets are pricing in 150bps of easing by end-2026—but the Fed may disappoint that ambition.

Canadian Economic Overview: Inflation Down, But So Is Growth

Canada’s economy is wobbling. In Q2:

- GDP contracted by -1.6% annualized

- Exports fell -27%

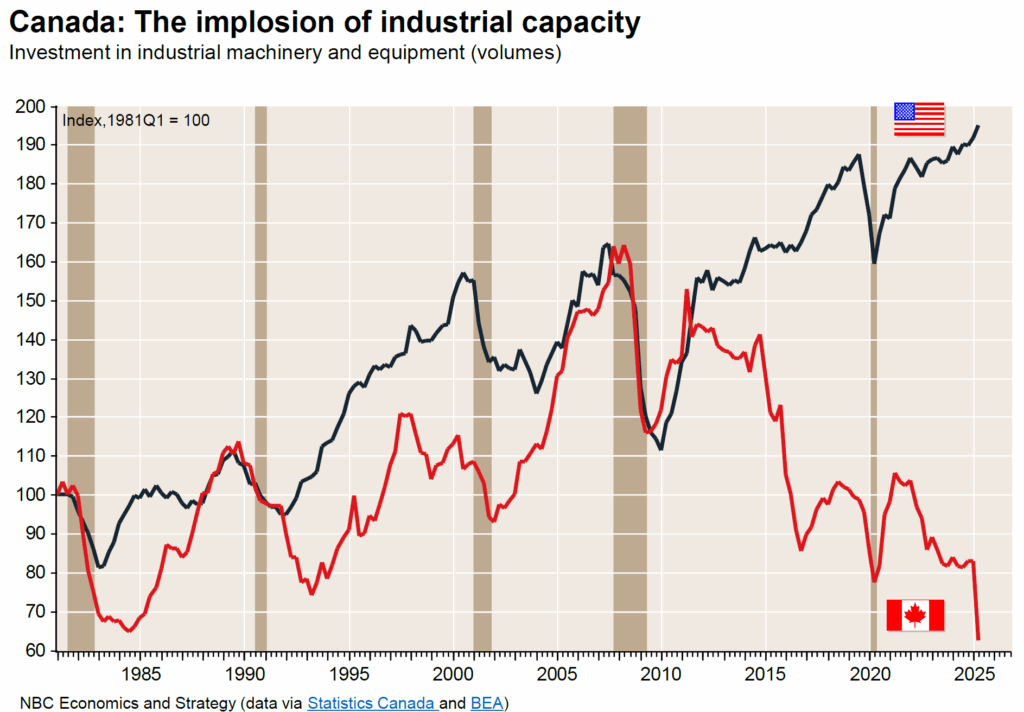

- Machinery & Equipment Investment dropped -33%, the 4th worst on record

Industrial capacity is collapsing. Investment in industrial machinery is now at its lowest since 1981, undermining productivity and long-term competitiveness.

Meanwhile, labour market deterioration accelerated:

- Unemployment hit 7.1%, the highest since Aug 2021

- Wage growth has slowed significantly

- Only 36% of private sector industries added jobs over the past 6 months

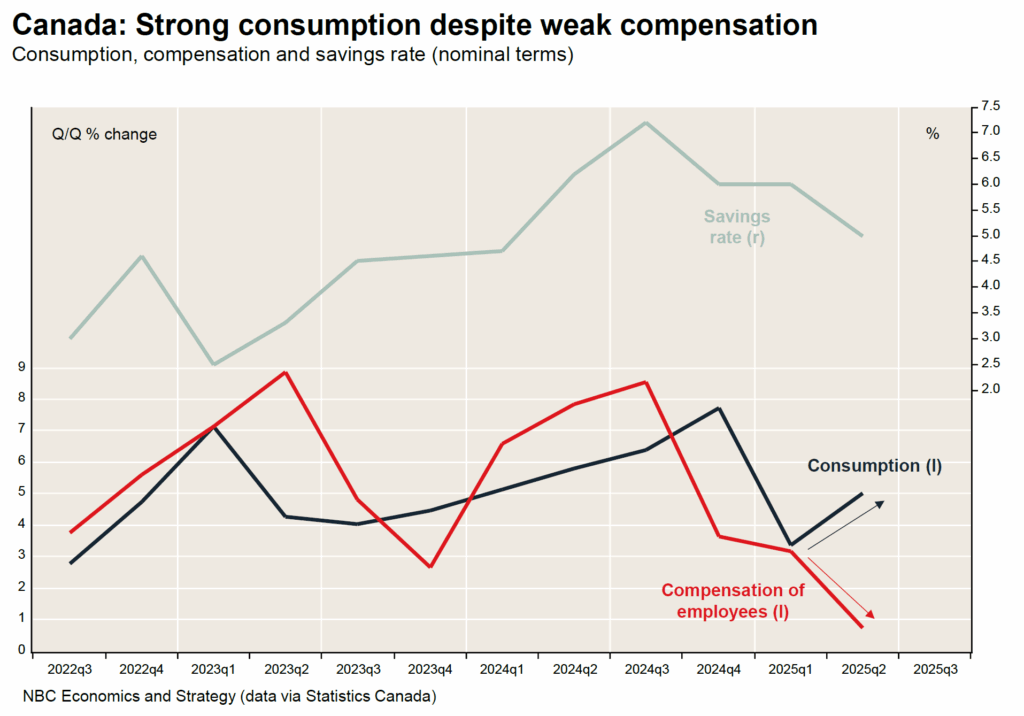

One bright spot: consumer spending, which rose 4.5% annualized last quarter. But before we celebrate this, it’s worth noting that the forward outlook is less encouraging, especially given that this surge came at the expense of household savings, which have declined across Canada. This raises concerns about the sustainability of spending and the broader economic resilience ahead.

GDP is expected to grow just 1.2% in both 2025 and 2026, with potential fiscal stimulus from November’s budget offering a possible upside catalyst.

Bottom Line Gold Glitters, But Don’t Be Fooled by the Glow

Q3 ended with broad-based optimism: equities surged, central banks cut rates, and soft landing narratives gained traction. But the underlying picture is more nuanced:

- Valuations are stretched, with the U.S. equity risk premium now negative

- Gold’s rally reflects deeper concerns about debt, currency credibility, and inflation

- Labour markets are softening on both sides of the border, raising the odds of further easing

- Canada’s structural weaknesses, especially in investment and productivity, are being laid bare by protectionist shocks

In this environment, we remain cautiously constructive on risk assets but are focused on quality, diversification, and real assets. October brings earnings season, U.S. inflation prints, and a pivotal Canadian budget.

Stay nimble and stay tuned.