InsightsThe End of an Era? U.S. Equity Dominance, Capital Flows, and the Inflection Point Ahead

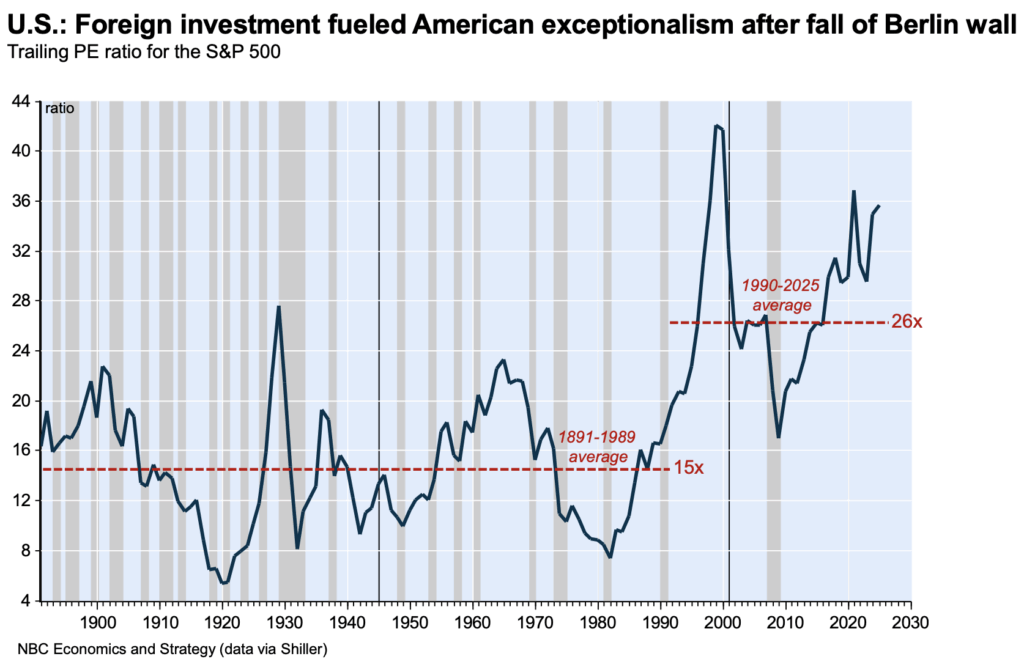

June 19, 2025 • 6 MIN READFor more than a decade, the dominance of U.S. equities has been nearly unchallenged. American markets, led by tech megacaps and a robust innovation engine, have not only delivered exceptional returns but have become the gravitational center of global capital. Investors from every continent—individuals, institutions, sovereign wealth funds—have flocked to U.S. equities, seeing them as a haven of stability, growth, and superior governance.

But as the second quarter of 2025 comes to a close, investors would be wise to ask: Is this era of U.S. supremacy entering a new phase—or ending altogether?

We explore how flows have driven U.S. returns, how that flow/return feedback loop created a structural imbalance, and why rising protectionism and shifting policy regimes may mark a critical turning point for global capital.

Capital Flows: The Real Engine Behind U.S. Outperformance

Market narratives tend to focus on earnings, innovation, or interest rates—but one of the most underappreciated drivers of performance is capital flow. Where money goes, momentum often follows. And for nearly 20 years, the answer to “where is the money going?” has overwhelmingly been: the United States.

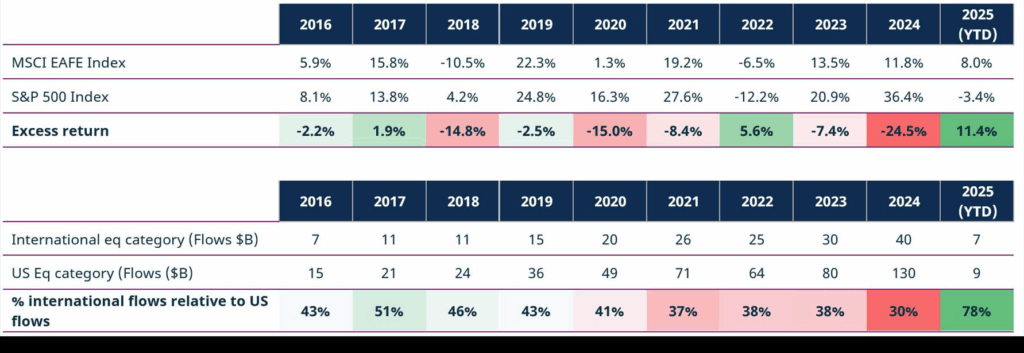

Take Canadian ETF flows as a case study. Since 2016, Canadian investors have poured over $499 billion into U.S. equities, compared to just $185 billion into international markets—a staggering $314 billion gap. This flow imbalance mirrors performance: over the past 15 years, U.S. stocks have outperformed international markets in 12 calendar years.

These flows weren’t random. They were a rational response to superior corporate performance, an accommodating regulatory environment, and the network effect of the world’s deepest capital markets. Tech leadership from companies like Apple, Microsoft, Amazon, and NVIDIA supercharged the cycle, driving performance and attracting even more capital.

From Flows to Structural Dominance

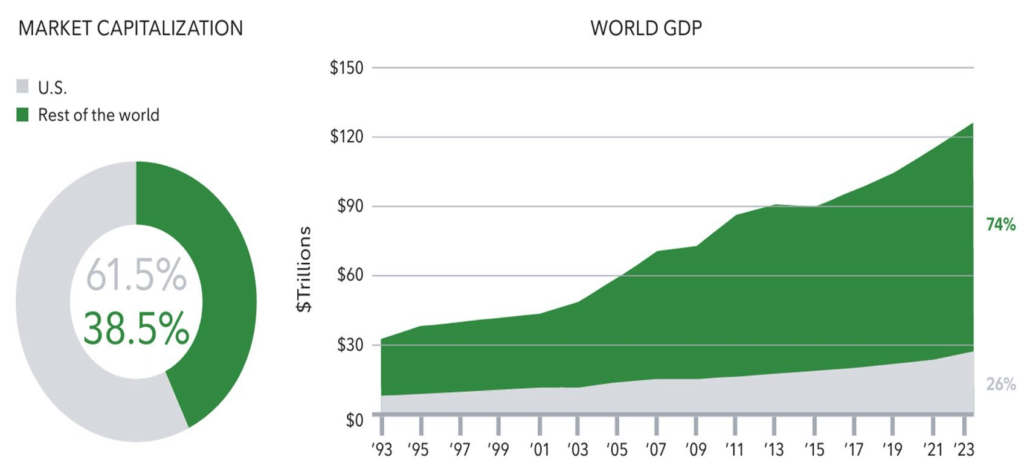

This sustained flood of capital has reshaped the global investment landscape. Today, U.S. equities represent more than 61% of total global equity market capitalization, according to the MSCI All Country World Index. Yet the U.S. economy only accounts for about 26% of global GDP.

This imbalance is striking. Capital allocation has diverged meaningfully from the real economy.

Part of this reflects just how productive and profitable U.S. companies have been. But it also reflects the reflexive loop between flows and returns: capital chasing performance, reinforcing valuations, and crowding out alternatives. And as the cycle matured, it became increasingly self-reinforcing.

The result? A world where many global investors are significantly overexposed to a single market, both directly and indirectly.

Cracks in the Foundation: Valuation, Volatility, and Policy Instability

Yet even before 2025, signs of fatigue were emerging. Valuations have become historically stretched, especially among U.S. megacaps. Investor enthusiasm for AI, automation, and software margins has reached euphoric levels—recalling previous periods where expectations far exceeded what companies could sustainably deliver.

This isn’t to say these companies aren’t high quality. But their dominance has created a narrow market where performance is increasingly driven by a handful of names. That makes portfolios more fragile and vulnerable to shifts in sentiment, regulation, or technology cycles.

More recently, the re-emergence of protectionist trade policy under the Trump administration has introduced a new and serious headwind. The chaos of “Liberation Day”—when sweeping tariffs were suddenly imposed—showed just how quickly capital confidence can be rattled.

Washington’s recent pivot to trade walls and localization isn’t just a headline risk. It’s a fundamental shift that challenges the open capital markets model that made the U.S. so attractive in the first place.

Geopolitics and the Case for Diversification

Global capital doesn’t disappear—it reallocates. And if investors begin to question the U.S.’s political stability, trade consistency, or regulatory reliability, flows will start to move.

Where might they go?

Europe, while slow-growing, has stabilized its inflation and avoided the extremes of U.S. policy flip-flopping. Japan is undergoing structural reforms and shareholder-focused changes not seen in decades. Emerging markets, though higher risk, offer demographic tailwinds, resource wealth, and faster growth potential.

The argument isn’t that these regions will suddenly outperform in a straight line. But after years of capital starvation and cheap valuations, even modest inflows could spark meaningful performance shifts. The risk/reward asymmetry is beginning to tilt in favor of these overlooked regions.

The Inflection Point: What to Watch Next

We may not be witnessing the end of U.S. market dominance—but we could be approaching the end of its unchallenged reign.

Here are the signals we’re watching closely:

- Capital Flow Reversals

Fund flows are one of the clearest leading indicators of investor conviction. Watch for persistent inflows into non-U.S. ETFs and mutual funds, especially from large institutional allocators. - Relative Valuations

The valuation gap between U.S. and international equities remains historically wide. A reversion to the mean could spark an extended catch-up trade in non-U.S. markets. - Policy Continuity

Markets crave predictability. If trade policies continue to flip-flop, or if tariffs disrupt supply chains and earnings visibility, capital may start seeking refuge in more stable jurisdictions. - Currency Stability

The U.S. dollar remains the world’s reserve currency, but any weakening trend—especially amid fiscal uncertainty—could make international investments more attractive on a currency-adjusted basis. - Corporate Behavior

Follow the multinationals. If global corporations begin shifting capex and hiring abroad to hedge against U.S. unpredictability, it could signal a broader realignment of global business confidence.

What This Means for Investors

For investors, the question isn’t whether U.S. markets are “good” or “bad.” It’s whether your portfolio is appropriately diversified for the world we’re heading into—not the one we’ve just lived through.

Concentration risk is real. And when capital is as crowded as it is today in a single market, the potential for asymmetric downside grows.

Now may be the time to revisit long-term allocations. That doesn’t mean abandoning the U.S. altogether—but it does mean recognizing that yesterday’s winners may not be tomorrow’s leaders. Diversification isn’t just a defensive tactic—it’s a proactive strategy for capturing return where capital is just starting to flow.

Final Thoughts

Capital flows have long driven U.S. outperformance. But as trade policy tightens, valuations stretch, and alternative markets quietly improve, the reflexive loop that sustained U.S. dominance may be weakening.

We don’t believe in trying to call tops. But we do believe in recognizing when the tide may be turning.

As we move through the second half of 2025, investors should consider whether they’re positioned for the next leg of the journey—or still clinging to the last one.

Sources:

- Morningstar ETF Flow Data

- MSCI Global Market Capitalization Reports

- U.S. Department of Commerce GDP Statistics