InsightsWhen Quality Stocks Fall Behind, History Suggests Paying Attention

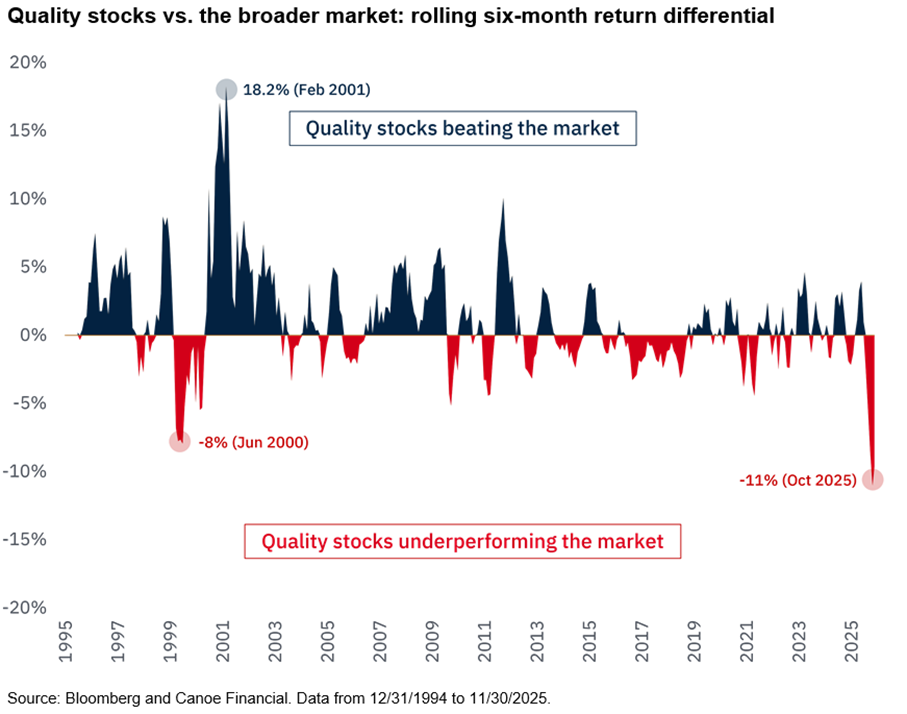

December 17, 2025 • 5 MIN READRecently, quality stocks have lagged the broader stock market by one of the widest margins seen in years over a six-month period. In simple terms, companies known for strong profits, healthy balance sheets, and disciplined management have underperformed the S&P 500.

At first glance, that feels counterintuitive. If solid businesses are falling behind, it can seem like fundamentals no longer matter. But history tells a different story. Periods when quality stocks fall furthest out of favour have often marked moments of opportunity rather than long-term decline.

To understand why, it helps to step back and look at how markets behave over full cycles, not just short bursts of enthusiasm.

What Are Quality Stocks?

Quality stocks are companies that consistently make money, manage debt carefully, and invest thoughtfully. They tend to have stable cash flows, durable business models, and management teams that focus on long-term value instead of chasing rapid growth at any cost.

These are not necessarily the most exciting stocks in the market. Their growth is often steady rather than explosive. But their strength comes from reliability. They earn profits today rather than relying on promises far into the future.

In short, quality companies are built to endure.

Why Quality is Getting Ignored.

When markets are optimistic, investors are naturally drawn to bold ideas. Fast-growing industries, new technologies, and companies promising major future breakthroughs capture attention. During these periods, investors are often willing to overlook weak profits or rising debt if the growth story sounds compelling enough.

And this is exactly what is happening today.

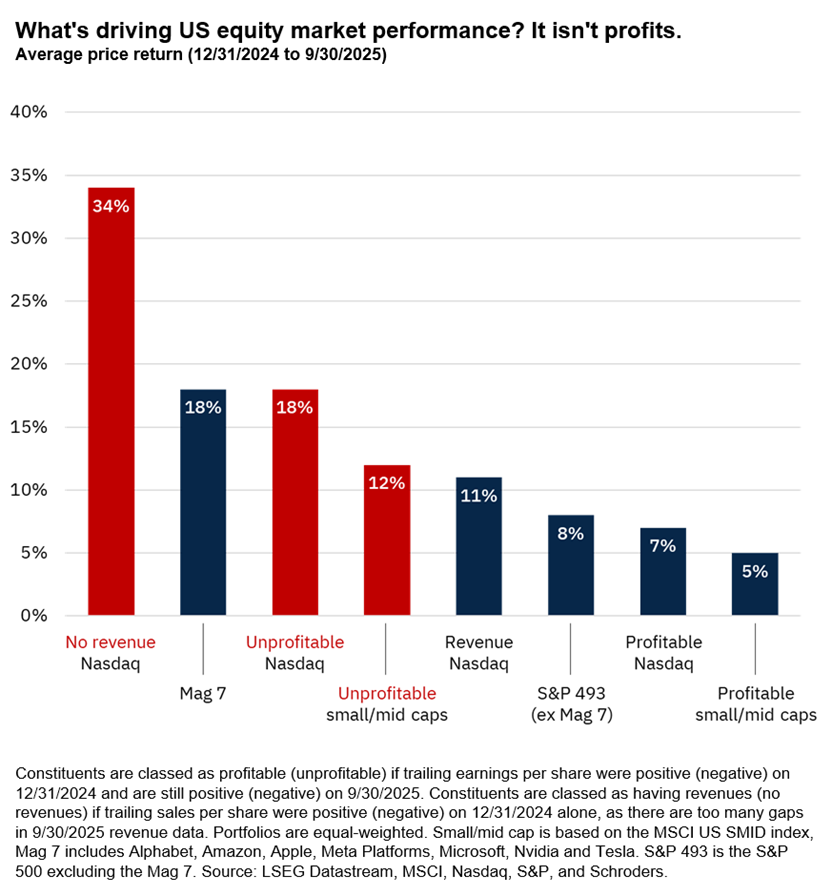

As seen by the chart below, Nasdaq companies with no revenues have delivered an average year-to-date price return of 34 percent. That is not just strong. It signals that investors are willing to bet heavily on long-term potential rather than current business fundamentals.

Meanwhile, profitable NASDAQ companies (quality business) are up a mere 7%.

Quality companies can look boring by comparison. They may already be profitable, but they are not promising dramatic transformation. When confidence is high, steady performance does not generate much excitement.

This behaviour is not new. It repeats itself in every cycle.

What Research and History Tell Us

Decades of financial research have shown that profitable companies with disciplined investment habits tend to deliver stronger long-term returns than companies that grow aggressively without regard for efficiency.

Put simply, businesses that generate cash and reinvest it carefully tend to outperform those that chase expansion for its own sake.

Another important insight is that profitability matters more than investors often realize. Companies that produce strong cash flow relative to the assets they use are better positioned to compound value over time. Even when they are overlooked in the short run, their fundamentals eventually assert themselves.

The key point is not that quality always outperforms. It does not. The key point is that when quality falls deeply out of favour, it often signals that expectations elsewhere are becoming stretched.

A Lesson From the Late 1990s

The late 1990s offer a clear example of this dynamic.

As enthusiasm for technology stocks surged, investors poured money into companies promising future dominance, regardless of whether they were profitable. More conservative businesses were pushed aside.

By mid-1999, quality stocks had fallen well behind the broader market over a six-month period. Many investors believed the old rules no longer applied.

When the cycle turned, it turned quickly.

As losses mounted in speculative areas, investors rushed back toward companies with real earnings and strong balance sheets. Within a relatively short time, quality stocks were outperforming the market by a wide margin.

What had seemed outdated suddenly became essential.

How Often Has Quality Worked?

Looking across history, quality stocks have outperformed the broader market in roughly 60 percent of rolling six-month periods since the quality index was created.

That means periods of underperformance are normal. They are not a failure of the approach. They are part of how it works.

Quality tends to struggle when optimism is high and risk-taking is rewarded. It tends to shine when reality catches up to expectations.

What Today’s Market Looks Like

Today’s market is not a repeat of the late 1990s, but it shares some familiar features.

A small group of companies is driving a large share of market returns. Investors are placing more emphasis on long-term growth potential and less on near-term profits. As a result, quality stocks have once again fallen behind.

The recent gap between quality and the broader market has reached levels that historically coincided with important turning points. That does not mean a reversal is imminent.

Markets can remain optimistic longer than expected.

But it does suggest that the balance of risk may be shifting.

Why Quality Eventually Comes Back

Over time, markets tend to reconnect prices with reality.

Companies built on optimistic assumptions eventually face limits. Growth slows. Costs rise. Financing becomes harder. When expectations are high, even small disappointments can have large consequences.

Quality companies face fewer of these challenges. They already generate cash. They already operate with discipline. They do not require perfect conditions to succeed. When investors refocus on earnings, balance sheets, and sustainability, quality stocks often reprice quickly.

The Bottom Line

Periods of strong optimism are not when quality stands out. They are when it is quietly discounted.

That discount has historically created opportunity for long-term investors. The recent underperformance of quality does not mean fundamentals are obsolete. It suggests they are being temporarily overlooked.

Cycles change. Narratives fade. But companies that generate real profits and manage capital wisely tend to endure.

When quality falls this far behind, history suggests it is worth paying attention.