InsightsMonthly Market Wrap – October 2025

November 10, 2025 • 6 MIN READOctober started with a chill, both in the air and in the markets, as volatility returned after months of calm. Early jitters gave way to resilience, with equities finishing higher thanks to strong earnings from U.S. banks and technology giants.

The debate over AI spending continues. Will today’s massive investments deliver results? There’s reason to believe they will, as AI promises to unlock new efficiencies and reshape productivity. But how much of that optimism will translate into real earnings over time? Valuations already reflect high expectations, raising questions about whether prices are inflated—echoing concerns reminiscent of the 2000 tech bubble. Meanwhile, stable oil prices are helping to contain inflation, giving central banks some flexibility even as rate cuts remain measured.

While the U.S. economy continues to defy gravity, Canada’s slowdown deepened. Beneath the surface, signs of strain in employment, investment, and inflation expectations suggest that volatility may return as we head into year-end.

Equities: Cautious Climb and Sector Rotation

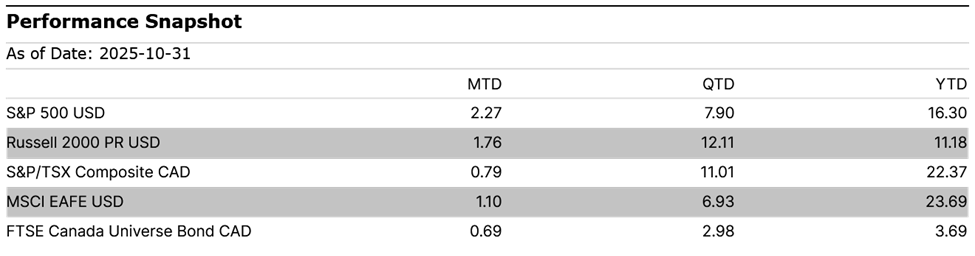

Global equities rose modestly in October. The S&P/TSX Composite gained 0.79%, held back by a pullback in gold stocks after months of outperformance. Year-to-date returns remain strong at 22.37%, led by materials, energy, and financials.

In the U.S., the S&P 500 advanced 2.27%, with all sectors posting positive returns. Gains were strongest in Information Technology (+3.5%), Consumer Discretionary (+3.4%), and Financials (+2.7%). Notably, small caps also staged a rebound, with the Russell 2000 up 1.7%, as easing rate expectations lifted sentiment.

Emerging markets were flat on the month, but remain leaders in 2025. Valuation spreads vs. developed markets remain wide.

Fixed Income & Credit: Another Solid month

October delivered another strong month for bonds following September’s huge rally. Canadian bonds gained 0.69%, bringing year-to-date returns to 3.69%. The backdrop remains supportive, but the pace of central bank cuts from here will likely be gradual.

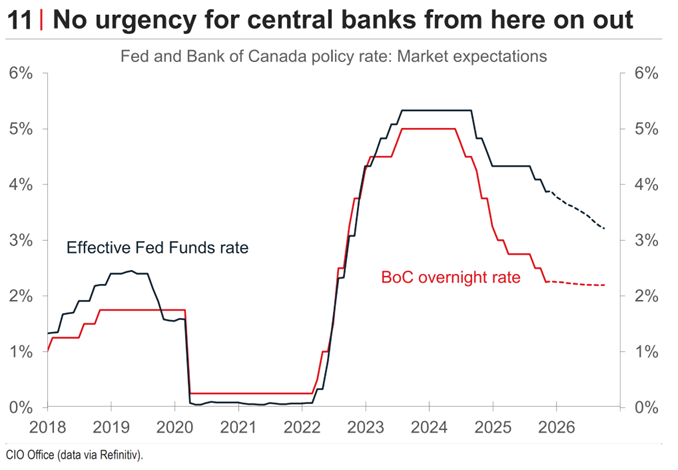

The strength of the U.S. economy makes aggressive easing difficult, even as policymakers signal a dovish tilt. Jerome Powell has emphasized that another cut in December is far from certain. Similarly, the Bank of Canada appears cautious, with Governor Tiff Macklem recently stating that rates are now “essentially at the appropriate level.” While we believe more economic pain may emerge in Canada, significant additional cuts seem unlikely.

For now, subdued oil, gasoline, and natural gas prices have helped keep long-term inflation expectations anchored near the Federal Reserve’s target, despite major shifts in global trade dynamics. Without this condition, justifying rate cuts would have been far harder. Markets currently expect three cuts in the United States and assign roughly a 40 percent probability of another cut in Canada over the next twelve months.

Commodities & Currency: Gold Keeps Climbing

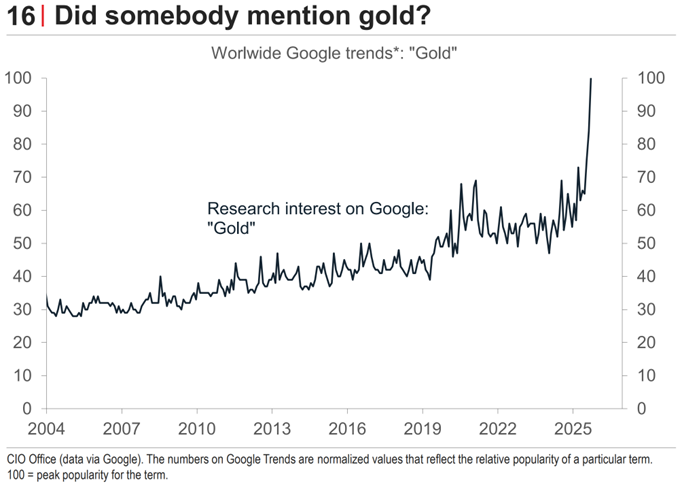

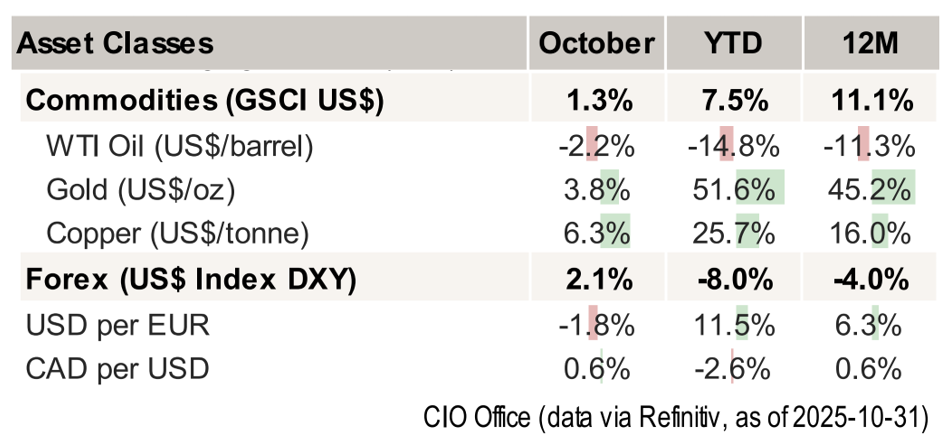

Gold extended its remarkable run in October, gaining 3.8% for the month and now up 51.6% year-to-date. The surge reflects a mix of falling real yields and heightened geopolitical uncertainty. In inflation-adjusted terms, gold is approaching levels last seen at its 1980 peak.

Finally, gold prices have captured investor attention like rarely before. Google search trends show a sharp spike in interest, and the sense of FOMO seems very real.

Other commodities were more subdued:

- Oil (WTI): -2.2% in October, now down -14.8% YTD

- CAD/USD: USD strengthened 0.6% against Canadian dollar

U.S. Economy: Resilient Amid Shutdown Uncertainty

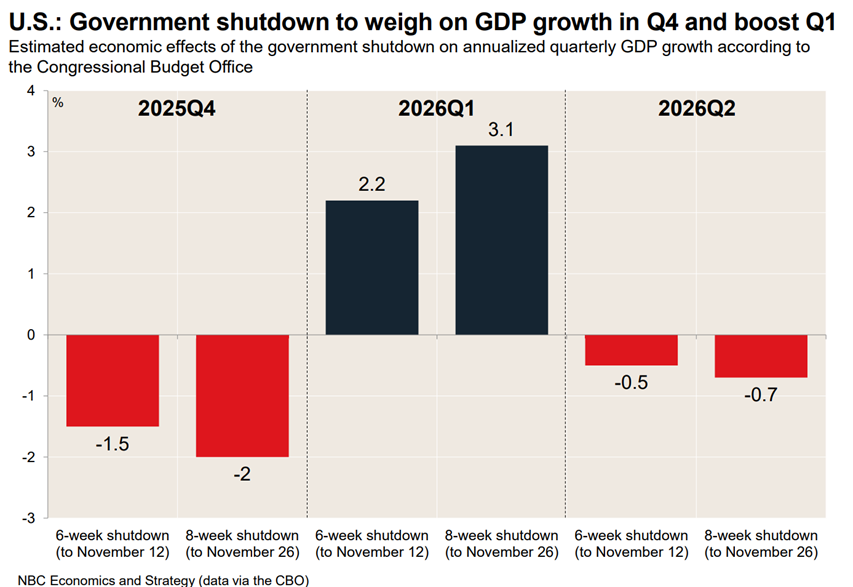

The U.S. economy entered October facing fresh uncertainty as the federal government shutdown disrupted the release of key data and weighed on growth. Estimates suggest the shutdown could trim annualized GDP growth in the fourth quarter by up to 1.5 percentage points, mainly due to reduced government spending and lower consumption by furloughed workers. However, most of this lost output is expected to bounce back in early 2026 once government operations resume.

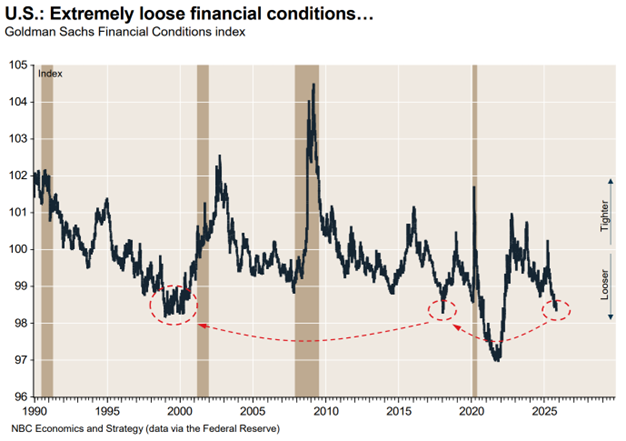

Despite these challenges, the overall economic backdrop remains resilient. Financial conditions are the most supportive they have been in several years, and recent fiscal policy changes are expected to help growth rather than hinder it.

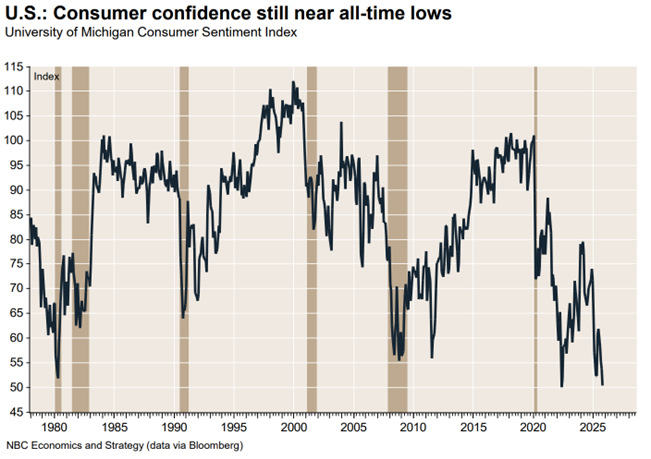

Private sector data paints a mixed picture: while some reports show a recovery in hiring, others highlight rising job cuts and declining consumer confidence. The University of Michigan’s consumer sentiment index recently fell to its second-lowest level since 1978, reflecting ongoing uncertainty among households.

Looking ahead, growth is projected to remain slightly above potential, with GDP expected to rise 2.0% in 2025 and 2.2% in 2026. Inflation remains a concern, but long-term expectations are still anchored near the Federal Reserve’s target.

Canadian Economy: Trade Tensions and Sluggish Growth

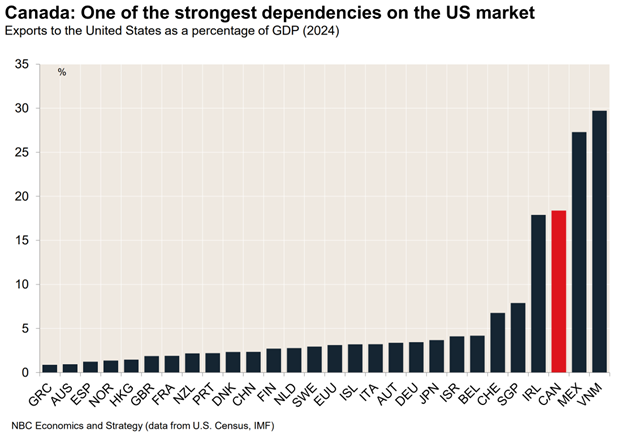

Canada’s economy continues to struggle with persistent trade tensions and slow growth. The ongoing dispute with the U.S. over tariffs and uncertainty around the renewal of the USMCA agreement have made it difficult for Canadian businesses to plan and invest, especially since exports to the U.S. make up a significant portion of Canada’s GDP. Many sectors are reporting negative impacts from tariffs, and business investment remains weak.

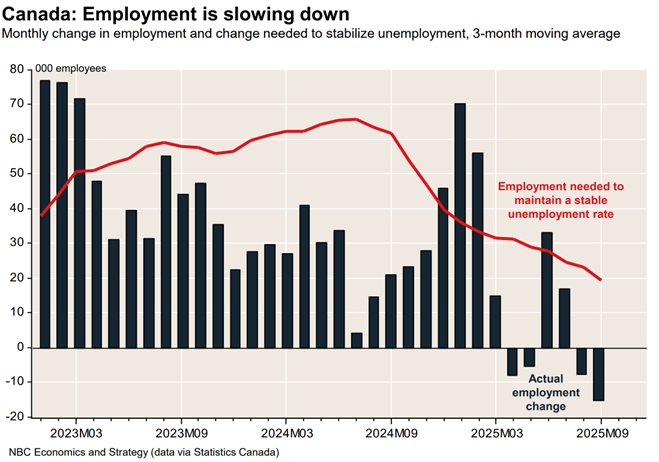

The labour market is showing signs of strain. Although there was a rebound in employment in September, it did not fully offset earlier losses, and the unemployment rate has climbed to 7.1%. Young people and new immigrants are facing the greatest challenges, with youth unemployment among immigrants reaching levels last seen during the global financial crisis. Hiring intentions are subdued, and businesses are reporting fewer labour shortages than at any time since 2009.

Economic activity remains sluggish. After a 1.6% contraction in the second quarter, growth is only slowly recovering, with hours worked and exports still below potential. Retail sales have started to contract, and business investment in machinery and equipment is weak. Inflation picked up in September, but core measures remain close to the Bank of Canada’s target, suggesting that further rate cuts are possible if economic weakness continues.

Bottom Line

October’s market resilience was encouraging, but underlying risks remain. While equities and bonds posted gains and gold continued its surge, the outlook is clouded by persistent economic uncertainty. The U.S. economy is holding up well despite policy and sentiment challenges, but Canada faces deeper headwinds from trade tensions, weak investment, and a softening labour market.

As we approach year-end, investors should stay alert to shifting conditions. Central banks are likely to move cautiously, and volatility may return if economic data disappoints or global risks intensify. Diversification and a disciplined approach remain the best strategies in this environment.